Get latest financial information, tips, insights & more

IPO: Understanding Initial Public Offerings and How They Work |

When companies grow and need to raise capital, they often turn to the public markets. One of the most common methods for doing so is through an Initial Public Offering, commonly known as an IPO. Understanding what an IPO is, how it works, and its potential benefits and risks is crucial for anyone considering investing in the stock market.

Insurance in India: Types, Importance & Benefits

In a world where uncertainties are an inherent part of life, insurance plays a pivotal role in providing financial security and peace of mind. Understanding the fundamentals and definition of insurance and the various types available in India is essential for making informed decisions about safeguarding your future. This comprehensive guide will delve into the meaning of insurance, its importance, and the diverse types of insurance policies available in the Indian market.

Form 16 in Income Tax: Definition, Benefits, Eligibility & Filing Guide

Understanding your tax obligations is essential for effective financial management, and one key document in this process is Form 16. This guide will walk you through what Form 16 is, its importance, and how to use it while filing your income tax returns.

What is Dividend Yield in Share Market? Definition and Calculation

Dividend yield is a crucial financial metric that investors use to evaluate the income generated from their investments in dividend-paying stocks. Understanding what is dividend yield can help investors make informed decisions about their portfolios, focusing not only on potential capital gains but also on the regular income generated from dividends. This comprehensive guide will explain the definition, calculation, importance, and impact of dividend yield on investment decisions, and explore the factors that affect it.

Understanding CAGR: Formula, Calculation, and Importance

When it comes to investing, knowing how to evaluate the performance of your assets is crucial. One of the most effective tools for this purpose is the Compound Annual Growth Rate (CAGR). This metric provides a clear picture of an investment's growth over time, making it easier for investors to gauge the potential return on their investments. In this blog, we’ll explore the definition of CAGR, how to calculate it, its importance, and its various uses.

An Introduction to Dividends and Their Importance in Investing

A dividend is a portion of a company's earnings distributed to its shareholders as a reward for their investment. Dividends are typically paid in cash, but they can also be issued as additional shares of stock or other property. Understanding what is dividend is crucial for investors looking to generate income from their investments. Dividends play a significant role in the overall return on investment, making them an essential aspect of financial planning. They represent a tangible benefit of holding a company's stock, rewarding investors for their confidence and investment in the business.

Investing in Large Cap Mutual Funds: What You Need to Know

Investing in mutual funds offers a diversified and professionally managed approach to growing your wealth. Among the various types of mutual funds available, large cap mutual funds stand out as a popular choice, particularly for investors seeking stability and consistent returns. But what exactly are large cap mutual funds, and why should they be part of your investment strategy? Let’s delve into these questions and explore the benefits, workings, and suitability of large cap mutual funds.

Systematic Withdrawal Plan (SWP) in Mutual Funds: A Guide to Regular Income

A Systematic Withdrawal Plan (SWP) is a financial facility that allows investors to withdraw a fixed amount of money from their mutual fund investment at regular intervals. This feature is particularly beneficial for those seeking a steady income stream, such as retirees or individuals requiring regular cash flow. SWP provides the flexibility to customize withdrawal amounts and frequencies, making it an attractive option for many investors.

Credit Card Minimum Due: What Every Credit Card Holder Should Know

Navigating the world of credit cards can feel overwhelming, especially with terms like "minimum due." Whether you’re a seasoned cardholder or new to credit, understanding what the minimum due means is essential for your financial health. In this blog, we’ll explore what the minimum due is, why it exists, and how it impacts your finances. By the end, you'll be equipped with valuable insights to manage your credit card payments wisely.

Importance of NRI Banking for Indians Living Abroad

For Non-Resident Indians (NRIs), managing finances while living abroad can be challenging. NRI banking solutions are designed to simplify financial management for global Indians, providing a wide range of services to cater to their unique needs. Let's explore the benefits of NRI banking, how NRIs can manage finances globally, and special products offered by Bank of Baroda.

What is a Working Capital Loan and How Can It Benefit Your Business?

In the fast-paced world of business, maintaining a steady flow of working capital is essential for smooth operations. A working capital loan is designed to help businesses manage their short-term financial needs, ensuring they have sufficient funds to cover daily expenses and operational costs. This comprehensive guide will explore what working capital loans are, their features, types, pros and cons, and how they can be used effectively in business.

What is an MSME Loan & how does it work?

MSME loans, or Micro, Small, and Medium Enterprises loans, are designed to support the growth and development of small businesses. These loans provide the necessary funds for business expansion, operational expenses, and other financial needs. The MSME stands for Micro, Small, and Medium Enterprises.

IMPS in Banking – Full Form, Features, Transaction Limit, Charges & how it works

Baking services are constantly evolving making services like sending and receiving money online through the banking app or net banking common these days. Available seamlessly for customers round the clock particularly when it comes to money transfer, gone are the days of tokens and teller counters even when transferring high-value funds. No longer are you expected to fill out withdrawal and deposit slips and wait for your turn when your token number is flashed, thanks to Internet banking life has become so much smoother and easier. Not just transferring money but ordering food, groceries, and utility items from the app or internet banking, IMPS will initiate quick payment.

Ways to Check FASTag Balance

FASTag is an electronic toll collection system in India, implemented by the National Highway Authority of India (NHAI). It is designed to eliminate the need for stopping at toll plazas to pay toll fees, thereby reducing traffic congestion and enhancing the convenience of road users. FASTag uses Radio Frequency Identification (RFID) technology for making toll payments directly from the prepaid account linked to it.

What is NEFT? A Complete Guide to National Electronic Funds Transfer

Now, you might be wondering, “what is neft fund transfer?”. NEFT full form in banking refers to National Electronic Funds Transfer. It is a widely used electronic funds transfer system in India. It enables individuals and businesses to transfer funds from one bank account to another seamlessly. The system is managed and regulated by the Reserve Bank of India (RBI), providing a secure and efficient means of transferring money. NEFT transactions typically involve the sender's and recipient's bank branches, and customers can initiate transfers through various channels such as online banking, mobile apps, or by visiting their bank branch. It has become an integral part of the Indian banking system, facilitating quick and reliable interbank transactions.

What is a Cash Deposit Machine (CDM)?

In today’s fast-paced world, banking technology has evolved to offer convenience at our fingertips. One such innovation is the Cash Deposit Machine (CDM), a device that allows customers to deposit cash directly into their bank accounts without the need to visit a bank teller. This guide explores what a Cash Deposit Machine is, how it works, and the benefits it offers to users.

What is Meant by Internet Banking and How Does It Work

In this day of technology, where the country is close to becoming a cashless economy, internet banking plays a pivotal role in shaping the consumer’s banking habits. With this evolution in banking technology, financial freedom is just a click away and has emerged as a comprehensive solution for all banking needs.

Recharge FASTag: Step-by-Step Guide for Easy Top-Ups

FASTag is an electronic toll collection system in India, introduced to streamline the toll payment process on highways. Utilizing Radio Frequency Identification (RFID) technology, it enables automatic deduction of toll charges from a prepaid or linked account without requiring the vehicle to stop at the toll plaza.

What is CVV on a Debit Card? Understanding Its Importance and Security Features

Whenever you purchase something online using a Debit Card, you will find a field requesting for CVV. The full form of CVV is the Card verification value. Debit cards have CVVs, and you can find the three digit number typed on the back side of the card. Flip the card around and the CVV number can be found below the magnetic strip. The first three of four digits of the CVV are hidden by the magnetic strip and the last three are visible. People are likely to get confused between CVV and PIN, but these are two different numbers and are required for different purposes. For completing any online transaction CVV is a must as it ensures secure transactions preventing risks and frauds. So let us help you understand the function of CVV.

What is VPA in UPI and How Does It Work?

With the advent of digital payment, life has become so much simpler. Gone are those days when cash payment was the only mode available, and people carried bulky wallets. Virtual Payment Address (VPA), a unique payment option part of the Unified Payments Interface (UPI), has largely replaced traditional payment. This simplified monetary transaction is proving to be an enhanced asset driven with security, and the acceptance of UPI payments across the country and businesses is almost a norm these days.

How to Update Your FASTag KYC: Step-by-Step Guide for Online & Offline Methods

Keeping your FASTag KYC information up to date is important. KYC, which stands for Know Your Customer, helps verify your identity and ensures secure transactions. When you first get FASTag, you provide KYC details. If this information changes, such as your address or ID number, you should update it with your bank as soon as possible. Before we delve into how to update KYC in FASTag, let us understand what FASTag is.

Mobile Banking - Benefits, Features & How to Get Started

In the age of smartphones and their ability to onboard various applications, banks have channeled their facilities and services through institute applications, making the lives of consumers easier to access banking services. With the need to visit the bank almost becoming unnecessary, you can open accounts, transfer funds though IMPS, NEFT, RTGS, UPI, MMID etc, manage your accounts like generating statement, Interest certificate, provisional certificate for Loan accounts, plan investments in Govt Schemes like PPF, SSA, KVP, SGB etc as well as in private entities like Mutual fund and Life Insurance. You can pay bills, Recharge your phone, DTH etc. Now banks have gone step ahead where you can avail digital personal loan where you can avail digital personal loan of a certain amount based on the transaction history of the account that too without visiting your branch and also you can get a monthly spending summary all from one banking app. So, what is mobile banking? Let us discuss the scope in detail.

IFSC Codes: What They Mean, How to Find & How Does It Affect Banking?

IFSC code stands for Indian Financial System Code. This code is a unique 11-character alphanumeric combination that serves as an identifier for a specific bank branch within the Indian financial system. Each bank branch that engages in electronic fund transfers is assigned a unique IFSC code to facilitate accurate routing and seamless transactions.

Maximizing Your Savings: Auto Sweep Facility Explained

The auto sweep facility is a unique banking feature designed to maximize your savings by automatically transferring surplus funds from your savings account to a fixed deposit (FD) account. When the balance in your savings account exceeds a predetermined threshold, the excess amount is "swept" into a higher-interest earning FD. This facility ensures that your idle funds earn better returns without compromising liquidity. Essentially, it combines the benefits of a savings account and a fixed deposit, providing both liquidity and higher interest rates.

Difference Between Visa and Mastercard: Which One is Right for You?

When it comes to choosing a debit, credit or prepaid card, one of the most common questions is, "Visa card vs Mastercard: which one is better?" Both Visa and Mastercard are widely recognized and accepted worldwide, but there are differences between the two that may influence your decision. This guide will explore these differences, helping you understand which card might be better suited to your needs.

Understanding Fixed Deposit Benefits for Senior Citizens: A Complete Guide

For senior citizens, securing financial stability and earning a reliable income from their savings is crucial. Fixed deposits (FDs) are one of the most popular investment options for this demographic due to their safety and assured returns. This guide explores the fixed deposit interest for senior citizens, the features of these deposits, their financial benefits, comparisons with other investment options, and tips on choosing the right FD.

Unlocking Financial Efficiency: How Cash Management Services Transform Banking

In the dynamic world of finance, Cash Management Services play a pivotal role in helping businesses maintain liquidity, optimize cash flow, and ensure smooth financial operations. Banks offer these services to manage their clients' cash transactions efficiently. This blog delves into the nuances of cash management services, highlighting their importance, types, functioning, and benefits.

What is a Bank Statement - Meaning, Features and Benefits

In today's financial landscape, it's essential for everyone to understand what bank statements are. whether you're an individual managing your personal finances or a business handling transaction. Essentially, a bank statement is like a detailed report for your bank account. It records every money move you make—like deposits, withdrawals, transfers, and any fees—over a specific period, giving you a clear picture of your financial situation. This article aims to delve into the meaning, features, and benefits of a bank statement, highlighting their importance in managing money effectively in today's financial landscape.

What Is Joint Account? - Meaning, Benefits, Application Process & How its Work

When it comes to managing one’s finances, having a bank account plays a crucial role. In the same way, a joint account is, as the name suggests, a financial arrangement that requires more than one person to open it. This account can work wonders, as it allows all the account holders to withdraw cash, write cheques, and make online payments. Let’s delve deeper into the blog and understand the technicalities of opening a joint account.

What is MICR Code? Understanding its Role in Banking Transactions

If you have used or even seen a cheque book, you must have noticed a few code numbers located at the bottom of every cheque leaf. This is a unique code for only bankers to decode and it plays an important role in banking transactions. This code is known as the Magnetic Ink Character Recognition (MICR) Code. Through this blog, you will get a thorough understanding of what an MICR Code is and its purpose in banking.

Calculating Interest on Savings Account: Factors, Tips & Formula

Saving money is a prudent financial habit that not only ensures a secure future but also opens doors to financial growth. One of the perks of having a savings account is the interest it accrues over time. Understanding how to calculate interest on your savings account can empower you to make informed financial decisions and maximize your earnings. In this guide, we will demystify the process of calculating interest on a savings account, shedding light on the key factors and considerations.

What to Do When You Forget Your ATM PIN

Your ATM Personal Identification Number (PIN) is like the key to your bank account. It’s a vital piece of information that safeguards your funds and ensures that only you can access them. Memorizing your PIN is crucial for security reasons, but we all know that memory lapses can occur, which is why it is important to make sure that your ATM pin is simple and can be easily recalled by you.

The Importance of Pension Funds: Secure Your Future with Steady Retirement Income

At a younger age, retirement planning may not be high on your priority list, as you might be of the mindset there is still a lot of time left. However, as age catches up with you, you might be in a hurry to save enough money for a comfortable life post retirement. As the golden years approach, the importance of a secure and comfortable retirement becomes increasingly evident. This is where pension funds come in handy. Now, you might be wondering, what is a pension fund? In this journey towards financial fulfillment, pension plans act as invaluable tools that provide a steady income stream during retirement. In this blog, we'll delve into the world of pension plans and their benefits.

Navigating New Fund Offers (NFOs): Opportunities, Risks, and Considerations

Individual investors have started to invest more in mutual funds in order to diversify their portfolios. By investing in mutual funds, they also seek professional management of their investments. New Fund Offer (NFO) is one of the key events in the life cycle of mutual funds. If you are looking forward to exploring new investment opportunities and diversifying your portfolio then NFOs are designed for you.

Demystifying RTGS: A Comprehensive Guide to Real-Time Gross Settlement

With the advent of technology, banking has gathered momentum closing gaps between time and space. These days fund transfer is no more a matter of grave concern let alone the trepidation of physical presence, security, and much more. With efficient technology, financial security has evolved through Real Time Gross Settlement (RTGS). Banks today have many modes of transferring funds, such as Immediate Payment Service (IMPS), National Electronic Funds Transfer (NEFT), and Real-Time Gross Settlement (RTGS). While the first two are the fastest and most secure modes of transacting small funds, RTGS is a swift and secure way of transferring large funds to another bank.

Understanding Gratuity: Your Complete Guide to Employee Benefits

In the complex landscape of employment benefits and compensations, the term "gratuity" frequently arises. Gratuity is a financial benefit offered to employees as a gesture of gratitude for their unwavering commitment and service. This comprehensive guide will thoroughly examine the concept of gratuity, delving into its definition, eligibility requirements, calculation methodology, and the significance of comprehending this essential employment benefit.

Investing in Debt Funds: A Comprehensive Guide for Steady Returns

Financial planning is one of the most crucial aspects of investment and at the same time, an individual needs to understand the various options that are available out there in the market which may further help an individual to make informed decisions. Among the various investment options that are available, debt funds is one of the most popular choices for those who are looking forward to steady returns with lower risk as compared to equity investments. This blog revolves around explaining debt funds, their functioning, features, associated risks and considerations for potential investors.

Understanding Bounced Cheques: Definition, Consequences, and Fees

In simpler terms, a dishonoured cheque also called as bounced cheque is the one that gets rejected by the bank due various financial and non-financial reasons such as lack of funds in the account, incorrect date, signature mismatch etc. In simpler terms, a dishonoured cheque also called as bounced cheque is the one that gets rejected by the bank due various financial and non-financial reasons such as lack of funds in the account, incorrect date, signature mismatch etc. This usually happens for a variety of reasons. When a cheque bounces, the bank may charge fees to the person who wrote the cheque (the issuer). Bouncing cheques repeatedly can hurt your credit score and make it harder to do business in the future. There can even be legal trouble / implications, if the cheque was dishonoured or returned unpaid for want of funds / insufficient funds.

Understanding MICR: Full Form, Meaning, and Its Role in Banking

While using cheque books, you must have noticed those magnetic code bars at the bottom of every cheque leaf. Those bars are unique ink codes that act as a special language that can only be understood and decoded by bankers. This is known as the MICR code. MICR stands for Magnetic Ink Character Recognition. It is a technology that involves the use of magnetic ink and special characters to process and verify the legitimacy of cheques. Introduced by the Reserve Bank of India, MICR technology has revolutionized the way banks process cheques and other financial documents. Read further to know more about MICR meaning in banking.

Understanding the Differences Between Home Loans and Mortgage Loans

In the world of finance, loans are as diverse as the people who avail them. But there's one common misunderstanding that we'd like to address: the difference between home loans and mortgage loans. Many people believe these terms are interchangeable, but they are actually two distinct financial products with different purposes, features, and implications. To ensure you make informed decisions when it comes to your homeownership or financial goals, let's break down the key differences between mortgage loans vs home loans.

Importance of Insurance in Protecting Your Financial Future

In this vast and unpredictable world, we are all trying to navigate the twists and turns that life presents us with. It may sound like a doomsayer, but it's essential to acknowledge the realities that can disrupt our carefully constructed plans. And that's precisely where the concept of insurance steps in to lend a helping hand.

Types of Salary Accounts: Know Your Options for Managing Your Income

Almost everyone who works as a salaried employee has a salary account created for them. If you are wondering what a salary account is, the answer is simple. It is a savings bank account created by a company or an employer to conveniently pay off salaries to its employees. A salary account helps simplify the process of crediting salaries for the employer, while offering a plethora of benefits to its employees, such as seamless mobile banking and online services. Let us take a look at the benefits of having a salary account.

Different Types of Life Insurance - Which One is Right for You?

Getting a life insurance policy is one of the most responsible decisions you could ever take, as it ensures that your near and dear ones are not left behind without financial support in case of an unforeseen event. It stands as a crucial financial safeguard, offering protection and security for loved ones in the event of an unexpected tragedy. However, navigating the world of life insurance can be overwhelming due to the multitude of options available. Understanding the various types of life insurance can help individuals make informed decisions that align with their needs and financial goals, while safeguarding their loved ones.

Difference between Term Insurance and Whole Life Insurance

In a world of endless options, where information flows ceaselessly, and choices multiply like rabbits, navigating the labyrinth of insurance can feel like a daunting task. And when it comes to the age-old debate between term insurance and whole life insurance, the confusion only deepens. The financial world seems to have a language of its own, a language that often leaves the average person feeling like an outsider.

Understanding EMI: Full Form Meaning, Calculation, and Factors

Know what EMI is, the full form of EMI, its meaning, definition, calculation methods, and factors affecting it. Learn everything about Equated Monthly Installment with this comprehensive guide from Bank of Baroda.

Demat Account for Mutual Funds: Your Comprehensive Guide

In today's dynamic financial landscape, managing your investments efficiently is crucial to building a secure financial future. One avenue that has gained immense popularity in recent years is the demat account for mutual funds. This innovation has revolutionized the way investors handle their mutual fund investments, offering convenience, security, and a streamlined approach to portfolio management.

Understanding FCNR-B Account: A Secure and Advantageous Option for NRIs and PIOs

In today’s highly interconnected world, individuals often find themselves navigating international waters, either for work, education, or business. Non-resident Indians (NRIs) and People of Indian Origin (PIOs) are no strangers to this global movement, and as they traverse international landscapes, they often look out for solutions to manage their foreign earnings efficiently. One such financial instrument that caters to their needs is the Foreign Currency Non-Residential –Bank (FCNR-B) account, which will be thoroughly explored in this blog.

Benefits of Having a Separate Salary Account and Savings Account

Separating your salary and savings accounts is like drawing a clear line between your finances. It might seem like a small detail, but it can make a world of difference in your ability to manage your money effectively and achieve your financial goals. It helps prevent mindless spending while motivating you to save at regular intervals, thus making it easier to achieve your financial goals. Through this blog, let us understand why it is important to have a separate savings and salary account.

How does Bank of Baroda stand out as the top choice for Salary Accounts?

Bank of Baroda Salary account is an account that goes beyond saving. It empowers the employee with attractive benefits. Bank of Baroda stands out as a compelling choice for the opening of Salary Accounts. Tailored to customers' needs, Bank of Baroda offers various types of Salary Accounts.

Understanding Dormant Bank Accounts: Risks and Solutions

We all have that one drawer in our homes where we stow away things we rarely use. It might be old gadgets, dusty books, or random knick-knacks. Similarly, in the realm of personal finances, many of us have a drawer equivalent in the form of our unused bank accounts. When it comes to managing our finances, many of us have a similar tendency to forget about our inoperative accounts. We might open one with all the intention of saving money, but then life gets busy, and the account stays unused for months. Your bank savings account is inactive, much like those items tucked away in that drawer. In the world of banking, this is a big no-no. In this blog, we'll explore what a dormant account is and why you should avoid leaving your bank account dormant.

Personal Loans for Travel-Financing Your Dream Vacation Responsibly

Do you dream of exploring the world, but your bank account isn't quite ready to support your wanderlust? Don't worry, you're not alone. Many people face financial constraints when it comes to embarking on their dream vacations. Fortunately, personal loans for travel offer a viable solution, enabling you to transform your travel aspirations into a reality. In this blog, we'll dive deep into the realm of travel loans, uncovering why they are an astute choice, gaining insights into the various types available, and discovering how to select the right one tailored to your needs.

Understanding FOIR: Calculation, Significance & Impact on Loan Eligibility

Financial stability and responsible borrowing are crucial aspects of managing your personal finances. When you approach a bank or financial institution for a loan, they evaluate your financial health by assessing various factors, one of which is FOIR. In this blog, we will delve into what FOIR is, its significance, and how it is calculated. So, let's get started on this journey towards understanding this vital metric.

Avoid Common Mistakes to File a Successful Insurance Claim

Insurance claims can be complex and overwhelming, especially when you're already dealing with the stress of an unfortunate event. Whether it's a car accident, property damage, or a medical emergency, filing an insurance claim is essential to receive the financial support you need. However, the process isn't always straightforward, and making mistakes can lead to delays, denials, or receiving a lower settlement than you deserve.

The Ultimate Guide to Vehicle Insurance: Types, Benefits, and How Does It Work

In the ever-evolving landscape of the automotive world, one constant remains – the need for reliable vehicle insurance. Whether you're driving a sleek sedan, a rugged SUV, or a zippy little hatchback, having the right insurance coverage is not just a legal requirement but also a crucial financial safeguard. In this comprehensive guide, we'll navigate the twists and turns of vehicle insurance, shedding light on its importance, the types of coverage available, and the various benefits that come with it.

Should You Include Your Parents in Group Health Insurance?

Health insurance plays a crucial role in ensuring financial protection against unexpected medical expenses. It not only provides coverage for the policyholder but also extends its benefits to family members, including parents. However, when it comes to including your parents in group health insurance, there are several factors to consider. In this blog post, we will explore the pros and cons of including your parents in group health insurance, discuss alternative options, and provide key considerations before making a decision.

Understanding Salary Accounts: Features, Benefits, and Opening Procedures

If you are wondering “what is a salary account?”, let us answer that for you. As the name itself suggests, a salary account refers to an account in which an employee’s salary gets credited. Salary accounts are a convenient way for companies to pay the salaries of their employees. These accounts come with a plethora of features and offer perks to the employees as well as the employers.

Mastering Monthly Average Balance: A Guide to Financial Security

In the ever-evolving world of personal finance, we often come across terms and concepts that can feel as elusive as trying to catch a fleeting breeze. "Monthly Average Balance" is one such term. Many individuals often perceive the minimum balance requirement as a tactic banks employ to restrict access to their funds or increase their earnings. However, this common belief doesn't necessarily hold true.

What is Goods and Services Tax (GST) in India - Meaning, Types & Benefits

Goods and service tax (GST) is a value-added tax (VAT) collectively levied on goods and services by the Central and State Governments. Following a dual structure comprising Central GST (CGST) and State GST (SGST), GST plays a significant role in revenue distribution formulated by the GST council. What is the GST Council? The GST Council is a joint forum of the Centre and the States, the Union Finance Minister, The Union Minister of State in charge of Revenue of finance, The Minister in charge of finance or taxation or any other Minister nominated by each State Government, making recommendations to the Union and the States on important issues related to GST.

Net Asset Value (NAV) in Mutual Funds: Calculation, Significance, and Importance Explained

Mutual funds have become a popular investment choice for investors as they offer professional management as well as diversification benefits. Mutual funds alone are capable of providing you with thousands of different options to invest in. But before investing, it is essential to understand certain terminologies associated with mutual funds.

Why Consider Gold as an Investment?

Gold has always held a significant place in Indian culture and traditions for centuries. But today, gold has also emerged as a popular investment avenue in India. The country has a long-standing affinity for this precious metal and it plays a crucial role in the country's economic landscape.

What is Travel Insurance? Exploring Coverage, Types, and Importance

Traveling is an exhilarating experience that unveils new cultures, breathtaking landscapes, and thrilling adventures. From exploring ancient ruins and monuments to basking on pristine beaches, the excitement of travel is undeniable. However, amidst the excitement, it's crucial to prioritize responsibility and safety, and one essential aspect that is often overlooked is getting travel insurance. This blog post delves into the concept of travel insurance, highlighting its importance and demonstrating how it can transform unexpected mishaps into manageable situations.

What is Health Insurance? A Comprehensive Guide to Benefits, Types, and Importance

With increasing medical expenses, health insurance acts as a safety net to meet our financial needs. Medical inflation is rising exponentially, and health insurance acts as a financial buffer against medical costs that would otherwise leave one's emergency funds and lifetime savings sufficiently depleted. Not just for individuals, but for the entire family, Health insurance is a necessary part of financial planning and should be integrated with investment purchases as soon as one starts earning. The earlier health insurance is planned, the better coverage is assured for individuals at lower premium rates with no medical tests. We will discuss various aspects of health insurance, their benefits, features, types, and how individuals can choose the right health insurance.

Understanding Repo Rate: Definition, Importance, Current Rates & Impact On Home Loans

In the complex world of finance, the repo rate, short for repurchase rate, emerges as a pivotal player in maintaining economic stability. This powerful tool resides within the arsenal of central banks, allowing them to regulate the financial system's liquidity and influence the broader economic landscape. With the help of this blog, let's embark on a journey to understand the intricacies of the repo rate, delving into its definition, functioning, and its profound impact on various stakeholders.

What is Intraday Trading? A Beginner's Guide to Day Trading Stocks

The term Intraday means “within the day”. As the name itself suggests, Intraday Trading refers to the purchasing and selling of stocks within the same day. Also known as day trading, intraday trading aims to capitalize on short-term price movements, leveraging market volatility to generate profits. Intraday trading revolves around the swift execution of trades with the objective of profiting from small price fluctuations. Traders participating in intraday activities typically do not hold positions overnight, minimizing exposure to overnight market risks. Instead, they rely on technical analysis, charts, and real-time market data to make informed decisions throughout the trading day. Intraday traders will look to settle all their positions when the market closes.

Step-By-Step Guide To Opening An NRI Account

As an NRI, having an NRI bank account in India is important for managing your finances. NRI Bank account opening is easy, but without proper information, it may seem like a challenge.

Complete Guide on NRI Banking

NRI's full form is Non-Residential Indian. NRI Banking is a pivotal financial service catering to the unique rеquirеmеnts of Indian citizens residing overseas. It is a spеcialisеd banking service that facilitates еfficiеnt management of NRI finances and NRI investments in India. NRI Banking also ensures seamless transfer of funds to the NRI's account in host countries when necessary.

Documents Required for an NRI Account Opening

If you are considering opening an NRI account, a common concern that comes to mind is: What documents are required for an NRI account?

Understanding Trading Accounts: Types, Features, and Benefits

Looking to delve into the world of investments? In the dynamic world of finance, investing in the stock market or other financial instruments is a popular means of building wealth. This is where opening a trading account is of help. To partake in these markets, individuals typically utilize a trading account. A trading account serves as the gateway to the realm of buying and selling securities, offering a platform for investors to participate in the financial markets. Now, let us understand in detail what a trading account is, including its features, types, and benefits.

All you need to know about the Senior Citizen Savings Scheme

Old age often brings uncertainty. Senior citizens face questions about their physical, emotional and financial health. The Government of India recognises the importance of financial security for the senior citizens and has started the Senior Citizen Savings Scheme (SCSS). Apart from providing financial security to senior citizens, it is one of the best tax saving options for senior citizens.

Who is eligible for the SCSS?

An Indian resident aged 60 years or above.

Indian resident above 55 years but below 60 years who have retired under the Voluntary Retirement Scheme rules or have appropriate superannuation. Under this, the SCSS account needs to be opened within a month of receipt of retirement benefits.

Retired defence personnel (excluding defence civilians) meeting particular terms and conditions can also avail the scheme on attaining the age of 50 years.

Non-Resident Indians, Person of Indian Origin, and members of a Hindu Undivided Family are not eligible for the SCSS.

Where can one avail the SCSS?

An eligible individual can avail the scheme through a private or public sector bank or the Indian Post Office. Since SCSS is a Central Government scheme, the rules and regulations of the scheme are standard across these institutions.

What is the interest rate on the SCSS?

The interest rate on the SCSS changes every quarter. The amount is calculated and credited every quarter, too. For the last financial quarter of 2019-20 i.e. January- March 2020, the interest rate is 8.6%.

What is the minimum and maximum deposit limits?

Individuals availing the SCSS can make lump sum deposits into their account. The minimum deposit stands at Rs.1000 while the maximum amount is Rs. 15, 00, 000. Any deposit greater than Rs.1000 will have to be made in multiples of Rs.1000.

When will the scheme mature?

The deposited amount matures 5 years after the date of account opening. The account holder can extend the account once, by a period of 3 years. However, the application for maturity extension needs to be made within one year of account maturity.

What is the interest on senior citizen scheme taxability?

There is SCSS tax exemption under Section 80C of the Income Tax Act, 1961. However, SCSS tax benefit is capped at Rs. 1, 50, 000.

In case of interest amounting to more than Rs. 50, 000, for a fiscal year, TDS is applicable starting FY 20-21.

What are the different benefits of the SCSS?

Being a government initiative, the depositor is protected by the facts associated with government schemes. This means, the depositor will not be affected by the economy.

The Senior Citizen Saving Scheme tax benefit serves as a good way of saving money as the SCSS tax is deductible under the Section 80C of the Income Tax Act, 1961.

In case of financial emergencies, the depositor can prematurely withdraw the amount with applicable penalties.

Now that you know how SCSS works, you can understand if it is the best financial option for you.

A Step-by-Step Guide to Setting Your New ATM Card PIN

Find out how to generate your ATM card PIN with the Bank of Baroda's step-by-step guide. Explore the activation process, choose a secure PIN, and get tips on keeping it safe. Read more about generating a new ATM PIN here!

Step-by-Step Guide: How to Insert ATM Card into an ATM Machine?

Learn how to securely insert your ATM card into an ATM machine with the Bank of Baroda step-by-step guide. Discover why it is important to insert your card, the processes that occur during card insertion, and essential safety tips for using ATMs.

How to Withdraw Cash from Your Credit Card at an ATM: Step-by-Step Instructions

Learn how to withdraw money from your credit card at an ATM with Bank of Baroda. Our step-by-step guide will walk you through fees, the process, withdrawal limits, card PINs & more to ensure a successful transaction

From PINs to Receipts: Everything You Need to Know About Withdrawing Money from ATMs

Learn how to withdraw cash from an ATM with simple steps from Bank of Baroda. Discover how to take money from an ATM, get security tips for withdrawing money & explore the various types of ATM cards & PINs available.

Easy as 1-2-3: How to Deposit Cash Through an ATM

Learn how to securely deposit cash at an ATM with Bank of Baroda. Follow our step-by-step guide to ensure a hassle-free experience. Start today and safely deposit your money through an ATM.

Decoding ATM: Full Form, Meaning, and Usage Explained

What is an ATM? Discover the full form, meaning, history, functionality, and benefits of ATMs with Bank of Baroda. Learn how to use an ATM, explore its evolution & its significance in the banking industry.

What is Digital Rupee and how does it work

Learn what the Digital Rupee is, why it's being introduced, how it works, the types of Central Bank Digital Currency (CBDCs), and how to acquire it. Gain a better understanding of digital currency at Bank of Baroda.

How To Activate Debit Card

Congratulations! You have just received your new debit card and you can’t wait to use it! Whether it's a replacement for an old card or your very first one, you're now on the path to making quick and easy transactions, while managing your finances smoothly. However, before you start swiping, tapping, or using your card for online purchases, you need to go through an important process. You need to activate your debit card in order to use it. In this blog, we'll walk you through the process of activating your debit card and provide you with some valuable tips to ensure a smooth experience.

Effective Financial Management For NRIs: Tips And Strategies

Living abroad as a Non-Resident Indian (NRI) can be an exciting and rewarding experience. However, one of the significant challenges faced by NRIs is managing their finances from afar. Balancing income, expenses, investments, and taxation can be a complex task, but with the right approach, it can be navigated successfully. In this blog, we will explore the various aspects of managing finances as an NRI, including setting financial goals, diversification and risk management, monitoring and adjusting financial plans, and understanding taxation. By the end, you'll have a clearer picture of which NRI account suits your financial needs.

What are the Benefits of an NRI Account?

Non-Resident Indian (NRI) accounts offer several benefits to individuals who are living abroad and wish to manage their finances in India. These accounts are provided by Indian banks and come in different types, such as NRE (Non-Residential External), NRO (Non-Residential Ordinary), and FCNR – B (Foreign Currency Non-Resident- Bank) accounts. The specific benefits of having an NRI account can vary depending on the type of nri account and the bank you choose, but here are some common advantages:

Managing Your NRI Account: Tips for Financial Success

Managing your finances as an NRI can be challenging due to the frequent travel and changing circumstances. Non-resident Indians often encounter rule changes distinct from those applicable to resident Indians, which can sometimes be complex to grasp.

Different Types of NRI Banking Services

Non-resident Indians (NRIs) play a vital role in India's economic landscape. While they may not be residents of India, there are multiple ways in which they contribute to the overall economy. This can be through business means, investments in India, or earnings from India while staying abroad. They cater to their unique financial needs, and thus, Indian banks offer a comprehensive suite of NRI banking services. Before diving into the different types of NRI accounts, let’s understand what NRI banking services encompass.

UPI ATM launched: Check How to withdraw cash from UPI ATM

Imagine a world where you can withdraw cash from an ATM without needing your trusty debit or credit card. Well, that world is here, and it's called the UPI ATM! It is a groundbreaking innovation in the world of banking that allows you to withdraw money without the hassle of carrying a card. In this blog, we'll walk you through the step-by-step process of how to withdraw cash from an ATM using UPI and explore its key features. So, let's dive in and learn how to use this exciting new technology.

A Complete Guide to Get a Loan Against an FD

It's simple to borrow money against a fixed deposit to get quick access to cash. In addition, you have the option of borrowing a loan against an FD as opposed to losing all or a portion of your investment. The Bank of Baroda loan against the FD program allows you to borrow up to 90% of the overdraft on your loan. The only amount that must be repaid is the original loan amount plus interest.

Understand Credit Card Features, Benefits and Tips

Credit cards come with various features and benefits, and when use wisely & cautiously are a great way to manage your finances and build a credit line for your personal & professional aspirations. Before you get a credit card, it's important to understand the features, benefits, and things you should kind in mind while using credit card. What makes credit cards popular is the ability to make payments with the card or through UPI if you have a RuPay Credit Card. This can be incredibly convenient, but it also means you need to be careful to not overspend and rack up debt. Ultimately, it's important to weigh the pros and cons before deciding whether or not a credit card is right for you.

Types of Credit Cards

With so many choices available to consumers, it can be hard to make sense of the different credit card options available in the market. In this post, we'll break down the key features and benefits of each type of credit card, so you can make an informed decision about which card is right for your needs. We'll also provide helpful tips on choosing the best card for you and using it responsibly.

Complete Guide on Credit Cards

Credit cards are a great way to manage your finances and build credit. With the right strategy, you can use them to pay for purchases, earn rewards, and even get cashback. In this article, we’ll cover everything you need to know about credit cards – from the basics of how they work and how to apply for one, to building your credit score and using rewards programs. Let us understand what is the meaning of a credit card.

Education Loans vs. Self-Finance to Study Abroad

Studying abroad is a dream for many students. It allows them to receive a quality education besides exploring new cultures and gaining global exposure; however, financing an international education can be a significant challenge for most students.

Common Overseas Education Loan Problems & Solutions

Pursuing higher education abroad is a dream for many students. However, the high costs involved in studying overseas can be a significant challenge. To overcome this obstacle, many students turn to overseas education loans. These loans provide the necessary financial support to fulfil the dream of such students.

How to Save & Invest for Your Child's Education Aboard

Quality education is one of the most important investments in your child's future. It equips them with the knowledge, skills, and opportunities necessary to thrive in today's globalised world.

Important Education Loan: Student Loan Terms You Should Know

Pursuing higher education is a dream for many individuals, but the rising education costs can often be a major hurdle. In such situations, education or student loans come to the rescue by providing the necessary financial support.

Analyzing Mutual Fund Performance

Investing in mutual funds is a popular choice for individuals seeking a diversified and professionally managed investment portfolio. Whether you are a seasoned investor or a novice, assessing the performance of your mutual funds is a critical aspect of successful investment management. By analysing the performance of your mutual funds, you can gain valuable insights into the effectiveness of your investment strategy and make informed decisions for your financial future.

Glossary of Mutual Fund Terms

Navigating the world of mutual funds can be daunting, especially for beginners. Understanding the standard terms and concepts associated with mutual funds is crucial for investors to make informed decisions and maximize their investment potential.

How To Calculate Mutual Fund Returns

Investing in mutual funds is a popular choice for individuals looking to grow their wealth over time. However, assessing the performance and profitability of these investments requires a clear understanding of how to calculate mutual fund returns. Mutual fund returns provide valuable insights into the growth or decline of your investment over a specific period. By analyzing these returns, you can evaluate the success of your investment strategy and make informed decisions for future investments. In this article, we will take you through the intricacies of calculating mutual fund returns step-by-step.

How to Invest in Mutual Funds

The asset under management (AUM) of the Indian mutual fund industry has surpassed ₹43 trillion in the past 10 years. Here are some of the factors that have fueled this growth:

Types of Mutual Fund Schemes

Over the past decade, the mutual fund industry in India has made significant progress. The key growth drivers were the entry of new players, changes in regulations that increased the popularity of Systematic Investment Plans (SIPs) and the overwhelming participation of retail investors. As a result, the mutual fund industry's Asset Under Management (AUM) grew about five-fold between May 2013 and May 2023. Furthermore, the total number of SIP accounts as of 31 May 2023 was at 6.53 core.

Complete Guide to Mutual Funds

Mutual funds, in essence, are the democratic soul of the investing world. They cater to the small retail investor looking to dip their toes into the vast ocean of equities, bonds, or other securities, and also to the seasoned player wanting to diversify their portfolio. Managed by professional money managers, these funds aggregate the investments from numerous individuals to buy a wide range of securities.

Understanding CIBIL Score Requirements for Education Loans

Learn the CIBIL score requirements for education loan and guidelines to secure funding. Ensure loan approval with a good CIBIL score for education loans.

How to Reduce Your Student Loan Debt

If individuals find themselves overwhelmed by the weight of their student loan debt and actively seek effective ways to reduce it, they need not look any further. This informative blog is dedicated to uncovering the secrets that can help them reduce student loan debt and regain financial freedom.

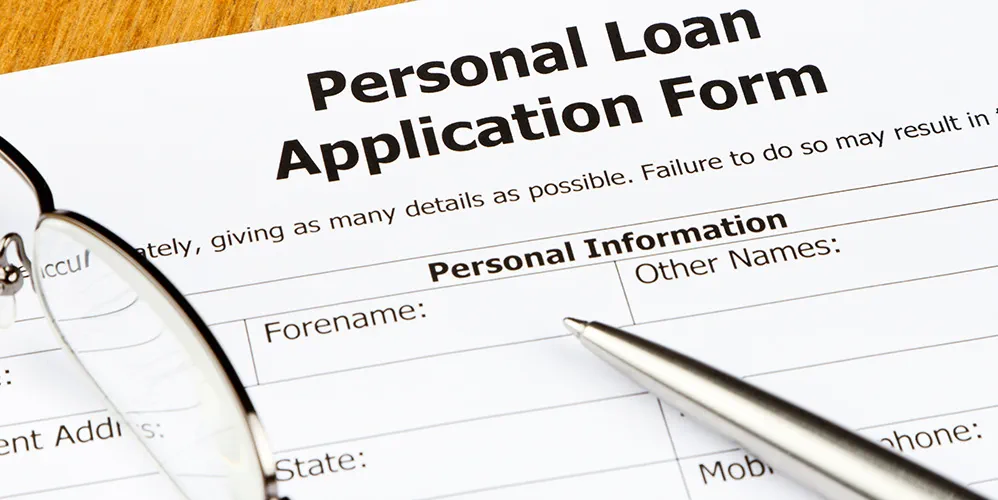

Understanding Personal Loan Part Prepayment and Closure

Personal loans are unsecured loans offered by banks and financial institutions to meet the financial needs of individuals. These loans may be used for buying a vehicle or a home, paying off a debt or funding an emergency; the list goes on. Personal loans are easy to obtain and come with a flexible repayment tenor. Nonetheless, these loans are often extended at high-interest rates and rigid terms and conditions. At times, a borrower may be instances where a borrower may want to close the loan before the due date. There are standard procedures for this, which can vary from one lender to another.

How to Get a Bank Statement Online at The Bank of Baroda?

The arrival of internet banking has transformed the way one manages their finances. It has revolutionized the banking sector. Customers can now access their bank accounts from the comfort of their homes or offices.

What Are The Types of Internet Banking?

The arrival of internet banking has transformed the way one manages their finances. It has revolutionized the banking sector. Customers can now access their bank accounts from the comfort of their homes or offices.

All about Demat Account Charges & Ways to Reduce Them

Trading and investing in the share market are gaining momentum among Indian investors. While there can be huge gains by investing in the share market, it also comes with certain associated costs. For trading or investing in the share market, you first need to open a demat account with a stockbroker.

Demat Account vs Trading Account: Key Differences

Most investors often come across the terms ‘Demat account’ and ‘Trading account’ and use them interchangeably. These accounts are essential for participating in share trading and investments and are considered largely similar. However, they serve different purposes. Understanding the difference between demat and trading accounts is crucial for investors to effectively manage their securities. Let us understand the difference between demat and trading accounts and determine their purposes.

What are the Benefits of Demat Account?

In 1997, the Indian stock exchanges transitioned to using Demat accounts. Before this, stock and share transactions had to be recorded on paper and completed in person using actual stock certificates.

How To Open Demat Account?

A Demat account (Dematerialised account) is necessary to be able to trade or invest in stocks online. Demat accounts hold the securities and other assets traded on stock markets.

How to Transfer Shares from One Demat Account to Another?

If you are an active investor, you might have wondered ‘Can I transfer shares from one demat account to another? The answer is yes! When you sell securities, you give your shares to another person. However, if you hold multiple demat accounts, then you can transfer your shares from one demat account to another demat account.

Different Types of Demat Account

Different types of specific demat account are suitable for different types of investors. Resident Indians use regular demat accounts while non-resident Indians can choose between repatriable demat accounts and non-repatriable demat accounts.

What is Demat Account?

In 1997, the Indian stock exchanges transitioned to using Demat accounts. Before this, stock and share transactions had to be recorded on paper and completed in person using actual stock certificates.

How to Use a Demat Account

A Demat account is a powerful tool for investors, providing numerous benefits and simplifying the process of holding and trading securities. By eliminating the need for physical share certificates, a Demat account streamlines the management of investments, making it more convenient and secure.

Common Internet Banking Frauds and Prevention Tips

Internet banking has made financial transactions more convenient and accessible for millions of people worldwide. However, this convenience of online banking comes with the risk of Internet banking fraud.

Regulatory Technology: Transforming Compliance in the Digital Age

In today's rapidly evolving business landscape, where technological advancements continue to reshape industries, regulatory compliance has become a critical aspect of organizational success. However, with the emergence of Regulatory Technology, or RegTech, companies now have a powerful tool at their disposal to streamline and enhance their compliance processes. RegTech has gained traction as a game-changer in the financial services industry and beyond, revolutionizing the way around regulatory compliance.

How to Use Internet Banking?

Are you new to internet banking and wondering how to use it? In this blog post, we will guide you through the steps required to start using internet banking , its various features, and how to stay safe while transacting online.

Key Features and Advantages of Internet Banking

Internet banking, also known as online banking or e-banking, has become a default mode of banking transactions for most individuals and businesses to manage their finances. With the advancement of technology, internet banking has revolutionized the way people conduct their banking transactions. The bouquet of features of Internet banking makes the banking experience more convenient and efficient. These features have made this mode of banking popular among account holders. So, what are the online banking advantages and disadvantages? Keep scrolling!

What is Tokenisation: Meaning, Working Process & Advantages

Once upon a time, there was a world where people carried sacks of gold coins and silver trinkets to buy goods and services. As time passed, technology advanced, and we moved into a world of digital transactions, where coins and trinkets became lines of code.

Understanding Bank of Baroda's ATM Services

Bank of Baroda is one of the most trusted and reputed banks in India, offering a wide range of digital products to make banking easier and more accessible for its customers. Among these digital products, ATM and Kiosk services play a crucial role in providing 24/7 banking services to customers. In this blog, we will discuss Bank of Baroda's ATM services, their benefits, and tips for using them safely.

How to Get a Loan to Buy Agricultural Land

Agriculture has been the backbone of India's economy for centuries, and the country's farmers play a crucial role in feeding the nation. If you have a passion for farming and aspire to own agricultural land in India, but lack the necessary funds, there's good news for you. With the availability of agricultural loans, you can now empower your farming dreams and acquire the land you need to turn your vision into reality. In this blog, we will explore the various aspects of agricultural loans in India and how they can support your farming endeavors. Loan to buy agriculture land is one of the best value propositions available for prospect farmers in India.

Guide to Getting Agriculture Loan: Application, Eligibility & Required Documents

Agriculture is the backbone of the Indian economy, contributing significantly to its GDP and employing a large portion of the population. However, farmers often face financial challenges due to factors such as unpredictable weather conditions, high input costs, and limited access to capital. To support farmers and promote agricultural growth, the Indian government and financial institutions offer Agriculture Loan with attractive interest rates, various schemes, and eligibility criteria tailored to the needs of farmers. In this blog, we will explore the details on how to get agriculture loan, the applicable interest rates, schemes guidelines, eligibility requirements, documents required.

Applying for Loan Against Agricultural Land: A Step-by-Step Guide

Obtaining a loan against agricultural land in India can be a valuable financial tool for farmers and landowners looking to meet their financial needs. This type of agricultural loan allows individuals to unlock the potential value of their agricultural land and utilize it for various purposes. In this blog post, we will delve into the process of obtaining a loan against agricultural land in India, outlining the essential steps and factors involved. We are sure that after reading this article, you will get the answer of all your queries like how to get loan against farm land, how much loan can I get on agriculture land, interest rate on loan against agriculture land, how to get loan against agriculture property.

Types of Agriculture Loans and Financing Options

Agriculture is the backbone of India's economy, employing a significant portion of the population and contributing to the nation's overall growth. In order to support farmers and enhance agricultural practices, financial institutions in India offer a range of Agriculture Loans tailored to meet the diverse needs of farmers and agribusinesses. These loans play a crucial role in providing financial assistance, empowering farmers to invest in modern equipment, improve infrastructure, and increase productivity. In this article, we will delve into the different types of agriculture loans and explore their features and benefits.

What is Prepaid Card: Meaning, Types & Benefits

In today's digital age, convenience and security are the two primary concerns for customers when it comes to making payments. With prepaid cards, you can have the best of both worlds. Prepaid cards are increasingly becoming popular, and it's essential to understand what they are, how they work, and the benefits they offer.

Know What Are the Advantages of Mutual Funds

Mutual funds have become a popular investment option for individuals looking to grow their wealth while minimizing risk. With the advantages they offer, it’s no surprise that the Indian Mutual Fund Industry has witnessed tremendous growth over the years. However, it’s important to understand the basics of mutual funds, who can invest in them, their advantages, and the factors to be considered before investing.

Does a Co-Applicant's Income Improve Your Chances of Getting a Higher Home Loan Amount?

A Home Loan is considered a once-in-a-lifetime opportunity for many people. That is why it would help to maximise your potential loan amount. The best to go about is to opt for a joint Home Loan. Let's find out what is a joint Home Loan and how you can improve your chances of getting a higher Home Loan amount.

7 Step-guide to applying for a Home Loan

All of us dream of becoming homeowners. It is a way of ensuring lifelong financial security; the kind that does not come from living in a rented home. But buying a home is a complicated process. Whether it is years of savings to be given as down payment or finding the right locality to invest in; the process of buying a home is elaborate. And since property investments take a huge chunk of savings, most of us rely on home loans. Yes, you can take out a home loan and pay it off in easy equated monthly instalments (EMIs) for tenures lasting up-to 30 years. Let’s understand the home loan procedure.

What is a home loan Top-up-edited

It's a new year and a new normal in the lives of most people. Yet Buying a home of one's own continues to be one of the biggest aspirations. However, with skyrocketing prices of real estate, property purchase remains out of the reach of many individuals. For this very reason, homebuyers are now increasingly opting for Home Loans to fund their dream house purchase. Banks and several lenders these days offer housing finance at competitive rates of interest, subject to several terms and conditions.

Understanding Home Loan Prepayment - Rules, Benefits, and Charges

If you are looking to reduce your debt burden, you should consider prepayment of home loan. As soon as your finances improve, you can choose to finish your home loan, either in part or in full. If you repay your home loan completely or in part before the scheduled tenure, it is called prepayment of home loan.

Know the eMandate Meaning, Benefits, Eligibility & Process

In today's digital world, convenience is the key. People are looking for ways to simplify their lives, and technology is playing a significant role in making that happen. One such example is the eMandate, which has revolutionized the way recurring payments are made in India.

What are the Consequences of Missing A Home Loan EMI?

A home loan can help you finance the purchase of your dream house. These loans are usually of a high value and, therefore, longer in tenure as well. Lenders typically sanction only 75% to 90% of the cost, and you are required to save enough to make

What is The Best Age to go For a Home Loan?

Buying a home is a dream for every individual across the globe. The only problem is affordability. Buying a house needs to fit the budget. One’s dreams need to be realistic to achieve it.

How Much Home Loan Can I Get As A Salaried Employee?

Real estate rates are rising with every passing day. It is no longer feasible for one to purchase a home simply with the help of their savings. You need to approach a bank to take out a home loan . But lenders need to be sure that you have the capacity to repay the loan, before passing your loan. To ensure you have the repayment capacity, they take a few important factors into consideration such as your net monthly income, credit scores, and credit repayment behaviour. If you are a salaried employee thinking how much home loan I can get on my salary, you need to read this article.

Home Loan Principal & Interest Rate Explained

Bank of Baroda offers a wide variety of Home Loans that you can choose from, based on your requirements. The bank offers loans of several lakh to a few crores in various Indian cities and towns. With its streamlined, online process, you can now apply for the loan online through the bank's website. You can even get a pre-approval for the loan, select a property based on your eligibility, and submit your documents online. But before you take a Home Loan , you should familiarise yourself with the various terminologies associated with the loan; two of which are most crucial. We are talking about the Home Loan principal amount and interest rates. Let's understand these in detail.

Your Complete Guide -To The Home Loan Disbursement Process

Now that you have a thriving career, you are done living on rent. You have already picked your dream house. You have also narrowed down on the bank that you want to borrow your home loan from-like for example Bank of Baroda, based on low attractive interest rates, flexible EMI options and speedy processing and simple straightforward documentation. Now before you approach a financial institution, it helps to know how a home loan is disbursed. Here is a simple guide to the home loan disbursement process where we discuss the three stages of home loan disbursement.

What is a Home Loan Processing Fee?

Banks and lending institutions levy a onetime charge on the different types of Home Loan products. This charge, known as the Home Loan processing fee. It is generally not deductible from the loan amount, and the borrower pays it separately. This is a fee to cover the loan processing cost incurred by the lender or the bank. Some banks may waive such processing charges for a Home Loan as part of special offers.

Calculating PPF Maturity Amount: Formulas, Compounding & Calculator

With the dual benefits of saving taxes and accumulating retirement funds, PPF remains a preferred savings method. An investor needs to open an account under this scheme to derive these benefits.

Complete Guide to Public Provident Fund (PPF) Account

The "PPF" in full form in banking, stands for Public Provident Fund, a popular long-term savings and investment instrument in India. This government-backed scheme enables individuals to build a secure retirement corpus or meet other financial goals while enjoying tax benefits under Section 80C.

How to Avail Loan Against Your PPF Account

Public Provident Fund (PPF) is a long-term investment with a tenure of 15 years that gives the investor a fixed income that is risk-free and tax-free. The account can be opened with a minimum balance of Rs.500 to a maximum deposit of Rs.1, 50,000 per year. It inculcates the habit of saving and planning for long-term goals. It also has a provision for availing loan against the PPF account investment for the short-term needs of the investor.

PPF Withdrawal Rules & Premature Closure

This article provides detailed information on PPF withdrawal rules. It covers the process of PPF withdrawal online, reasons for withdrawal, how to withdraw the PPF amount, PPF extension on maturity, partial withdrawal rules, and FAQs related to PPF withdrawal. How to Withdraw PPF Amount Online?

Step by Step Guide on How to Open a PPF Account

PPF accounts can be opened at designated banks and post offices across the country, with the option to invest either online or offline. The investment tenure for PPF accounts is 15 years, with the option to extend the term indefinitely in blocks of 5 years after maturity.

How to Transfer Your Existing PPF Account to Bank of Baroda?

Public Provident Fund (PPF) is one of the most popular investment avenues, not only among investors but also among taxpayers. One can invest in PPF through a bank or post office.

Complete Guide on Banking Services for Women

From Gen X to Gen Z, a conscious mindset change is palpable amongst women earners who have not only earned but also invested. These women acted as financial agents, preparing society towards change with confidence and competence. However, in the words of *Linda Davis Taylor, CEO, and chairman of Clifford Swan Investment Counsellors, "Wealth without knowledge is wealth wasted." Though many women have earned money, personal finance for women has been largely driven by their fathers or spouses who have taken care of their banking and investments both amongst the literate and illiterate earners.

What is Women's Savings Account?

Financial independence is a necessary component of modern society. With more women becoming self-sufficient and self-employed, the need for financial security and stability is more important than ever. Women have unique financial needs, which the traditional banking system has not always met. To meet these needs, women’s savings account have emerged as a practical and tailored solution. In this blog, we will discuss women's savings accounts and their benefits.

Government Schemes for Women Entrepreneurs in India

In India, where there are over 15.7 million women-owned enterprises and women are driving the start-up ecosystem, female entrepreneurship is gaining ground. It is anticipated that during the next five years, this number will rise by 90%. Despite their growing zeal, women entrepreneurs still face a variety of challenges, such as bias against them because of their gender, a lack of funding, and inadequate support. The Indian government has introduced a number of programmes to assist female entrepreneurs in response to these difficulties.

AI and Fintech: A Match Made in Heaven?

In recent years, there has been a rapid rise in the use of

Artificial Intelligence (AI) in the financial technology

(fintech) industry. From automated investment platforms

to fraud detection systems, AI has revolutionized the way

financial services are delivered and managed.

AI in fintech refers to the use of machine learning

algorithms and other AI technologies to streamline

financial processes, improve customer experiences, and

reduce operational costs. With the increasing availability

of data and advancements in machine learning

algorithms, AI has become a game-changer for the

financial industry providing institutions with valuable

insights on customer behaviour, market trends, and

investment opportunities.

Top Indian Government Schemes to Invest in 2023

The government introduces new investment plans to increase its residents’ income and financial status. These new government schemes are available to everyone who wants to participate, regardless of gender, marital status, socioeconomic status, location, etc. However, it is up to the residents to analyze several plans and select the one that best meets their requirements to maximize their income flow.

What is Minimum CIBIL Score Required for Credit Card

Are you looking to apply for a credit card? Do you know the minimum CIBIL score required for getting it approved? In this blog, we will be discussing everything related to CIBIL scores and how they affect your eligibility for a credit card. We will cover topics such as how to check and read your CIBIL score report, what factors determine the minimum CIBIL score required for credit card approval, how to improve your CIBIL score, and the benefits of having a good CIBIL score. We will also explain the impact of having bad credit or low CIBIL scores on credit card approval and offer some tips about which credit cards are suitable for people with bad credit or low CIBIL scores.

What is Credit Card Limit and How to Increase It?

A credit card limit is the maximum amount that a cardholder can spend on their respective credit card within a given period of time. And if you’re looking to increase your credit card limit, it’s important to consider your financial goals. If you’re looking to build credit, an increased credit limit could help you get there, as long as you’re careful to not spend more than you can afford.

5 Tips On How To Use Credit Card Wisely

In today’s world, credit cards have become increasingly popular and convenient. Credit cards can be a great tool for budgeting and building credit, however, it’s important to use them wisely. This article will offer tips for how to best use your credit card so that you can enjoy the financial freedom they bring with true happiness in your heart. We will look at key topics such as setting spending limits, avoiding cash advances, and more, along with sharing some famous quotes. By the end of this article, not only you should feel confident in your ability to use your credit card in a responsible manner, you will learn some famous quotes that we swear by at all times.

Understanding Cheques: Types, Features, Filling, Cancellation & Requests

A widely used mode of cashless payment is the cheque. Even in the age of digital banking , it continues to be significant in the banking industry. It is used in both small and large transactions. It can be used in various transaction types, from paying an employee to clearing utility bills. This mode of payment is preferred by many as it involves the convenient and secure transfer of funds. One can read further to know more about cheques, starting from a cheque definition to the different types of cheques.

What Is Tax Saving Fixed Deposit?

Opening a term deposit to earn interest income is an excellent way to make use of the funds lying in your bank account. But by opting for a tax saving fixed deposit, you can also earn interest income and get a tax benefit. Bank of Baroda’s Baroda Tax Saving Fixed Deposit helps you to save tax while earning income.

TDS on Fixed Deposit Interest

When one receives a payment, the person making the payment must deduct tax before paying. The tax thus deducted is called tax deducted at source (TDS), which the payee has to pay to the central government.

How is Interest on Fixed Deposits Calculated by Banks?

A fixed deposit (FD) is one of the safest investment instruments banks offer customers. It allows customers to invest a certain amount of money for a fixed period safely and securely. However, you may be interested in finding out how to calculate your fixed deposit interest rate. Well, you can use a fixed deposit calculator online for this purpose.

How To Open A Fixed Deposit Account

Time deposits or Term deposits are most commonly known as fixed deposits. Apart from mobilising funds from demand deposits like savings and current accounts, banks also resort to fixed deposits to raise funds. Fixed deposit, like the word suggests, have a fixed duration.

Complete Guide on Fixed Deposit (FD)

In India, fixed deposits (FDs) are considered one of the safest ways to invest one's hard-earned money. FDs are not only easy to begin, but they also offer good returns too. If one's priority is to save money to meet their financial goals without taking risks while receiving guaranteed returns, then investing in an FD is one of the best options.

Fixed Deposit vs Recurring Deposit: Which is the better option?

The process of wealth creation requires discipline. Money must be put away systematically, over a period for wealth to grow. Whether you choose to invest in the stock market, commodities market, mutual funds or even opt for conservative methods of savings such as fixed deposits and recurring deposits; each way of savings comes with its own set of features and benefits. Most people begin with small monthly savings in the form of a recurring deposit, which they convert into a fixed deposit upon maturity. But this is just one way to go about it. In this article, we shall highlight the key differences between fixed deposit and recurring deposits. However, to do so, we need to understand what a fixed and a recurring deposit actually is.

Features and Benefits of Fixed Deposit

A fixed deposit is one of the most popular investment options in India. Several people consider fixed deposits as the best investment option and invest a significant portion of their savings in this instrument. But what is a fixed deposit?

Various Types of Fixed Deposits for Your Investment Needs