New Guidelines on Digital Lending Issued by RBI

21 Oct 2022

Table of Content

Owing to the rampant malpractice in the digital lending space, the Reserve Bank of India mandated digital loans to be credited directly to the borrower's bank account. A third-party inclusion will not be acceptable. Along with this norm, the RBI regulations suggest, that the charges to the Lending Service Providers (LPS) should be paid by the digital lending entities and not the borrowers.

What prompted RBI to introduce Regulation on Digital Loans?

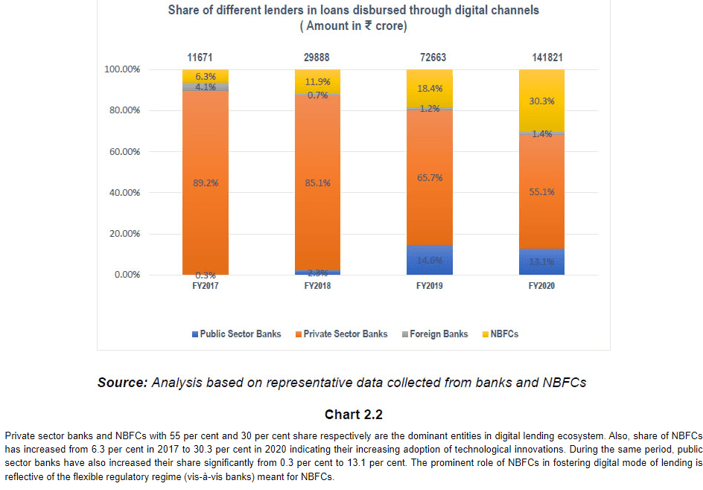

India's digital lending landscape had upped with the riveting influence of digitalization in the past few years. With rampant smartphone usage and other technologies taking place with the fast-paced internet penetration, customers growing expectations lapped this rising change amid regulated environments. Digital loan disbursal count was at 12 times high thanks to the diverse influence of fintech players and digital lending models by the end of 2020. Both private banks and NBFCS 2020, took lead in the lending ecosystem and almost fifty-five per cent to thirty per cent of loans found disbursal through digital platforms.

Banks were drawn by the Unregulated Digital Frenzy

The RBI cited that private banks showed a greater share in digital lending but when it came to lending by digital mode NBFCs outdid private banks by 10%. Private banks too have invested heavily in technologies that improve customer experience leading to personalised service and products. Products include loans both personal and secured, digital business loan, vehicle loans, individual MSME loans, loans for the salaried and young generation. Fintech NBFCs have spearheaded these innovative approaches in digital lending taking a lead by tying up with e-commerce firms to not just fund buyers but listed business suppliers in the marketplace.

Financial institutions started partnering with aggregators, marketplaces, payment facilitators, wallet companies and other such entities. Marketplace aggregators along with fintech NBFCs, and technology service providers, used banks and NBFCs at the bank end as manufacturers of loans when booked. This made way for potential risk as these entities provided enhancements that were not purview of the RBI. New products differentiated as loans of terms, tenure and payment characteristics like Buy Now, Pay Later (BNPL), a point sale credit product became more innovative products.

The Risks and Challenges in Digital Lending

The increased use of digital lending applications from non-financial services, and unregulated entities have resulted in unethical business practices, data breaches, and mis-selling. The chief concerns in the portfolio include:

- No regulatory checking authority when disbursing digital consumer loans, digital business loans or instant loans.

- Missing pre-emptive mechanisms that safeguard against fraudulent digital lending entities.

- Unverified and unmonitored loan service providers’ (LSP) and apps for digital lending.

RBI Laid Regulation

Viewing all these challenges and more the RBI has curbed the engagement of third-party engagement, mis-selling, data encroachment, unfair business practice and the charging of exorbitant interest rates along with unethical recovery methods.

RBI segregated digital lenders into three entities:

- First those under the RBI and permitted to carry out digital lending.

- Second those that have been authorised to lend following statutory regulations and provisions but are not under RBI's regulation.

- Third, are lenders outside the purview of statutory and regulatory provisions.

The regulations directly target digital loans belonging to the regulated entities of RBI and the LSPs extending credit card facilities and services.

On January 2021 a Working Group of RBI was set up for digital lending through online platforms and mobile applications. The working group came up with institutional and legislative guidelines that regulate illegitimate lending.

Do these guidelines suggest that the RBI is against Digital Lending Practices?

RBI supports orderly growth and credit delivery through digital lending methods and fintech loans. The purpose of bringing in some strict regulations and monitoring is to mitigate all unlawful activities. It establishes that all digital loan disbursals and repayments should be executed between the borrowers’ bank account without the interference from a third party or an LSP pool account. It also makes clear that any fee or charges payable to LSP, while intermediating credit should be borne by the RE and not shouldered by the borrower. For the borrower to proceed with the loan executing contract, a standardised Key Fact Statement (KFS) must be produced.

The borrower should be given the freedom to exit in the cooling off/lock-up period with payment of the principal and Annual Percentage Rate (APR) without penalty. The REs and the LSPs should be able to deal with the fintech loans and digital lending grievances through their nodal grievance redressal officer. The details of the officer must be displayed prominently on the website of the RE, its LSPs and DLAs.

Further, all complaints lodged by the borrower should be resolved by the RE within 30 days. If no action is taken, a complaint in the reserve Bank Integrated Ombudsman Scheme (RB-IOS) can be lodged.

All data collected by DLA/LSPs should have complete consent of the borrower with explicit options to accept, revoke or delete previously consented permissions.

The guidelines recommended by the working group have been accepted in principle by the RBI, but the fact that more examination is required on them has not been ruled out. Further engagement from the central government and stakeholders will iron out the technical complexities with legislative intervention laying down the best institutional practices.

Conclusion:

It cannot be denied that digital lending is convenient for both customers and providers. However, the need for regulation on this platform is essential. Therefore, easing some of the regulations while keeping the best interest of customers in view and with constant monitoring and customer redress platforms, digital loans can be made more approachable with safety. If you are looking for reliable digital loans, safely trust the Bank of Baroda digital loan, which is amplified with protection. Offering cautious guidelines for customer convenience the digital lending by Bank of Baroda is meant for your convenience with the best account protection methods. Visit the Bank of Baroda website today.

Popular Articles

Guide to Getting Agriculture Loan: Application, Eligibility & Required Documents

Tag Clouds

Related Articles

Increased Interest Rates for Senior Citizen Savings Schemes, KVP, NSC & Post Office Time Deposits

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.

How Tokenization Will Change Your Online Purchase

Making digital payments and paying for your online purchases will be very different from what you have done up until now. This is because, according to the Reserve Bank of India (RBI) standards, no online platform or payment gateway will be able to save credit card information in its entirety from October 1. This is what card tokenization is. Other aspects of online transactions via cards will stay the same and you will use your credit or debit card to pay for your purchases. So, what will change, indeed? What is tokenization in effect? Continue reading to learn more.

New Credit Card Rules Effective from July 1, 2022

On 21st April 2022, the Reserve Bank of India (RBI) released a notification named ‘Master Direction – Credit Card and Debit Card – Issuance and Conduct Directions, 2022. The notification includes new rules and regulations pertaining to the issuance of unsolicited facilities, credit card closures, new credit card issuance, etc. The new rules apply to all Scheduled Banks (except Payment Banks, State Co-operative Banks and District Central Co-operative Banks) and all Non-Banking Financial Companies (NBFCs) in India. If you are a credit cardholder or plan to apply for a new credit card, here are the new credit cards rules effective from 1st July 2022.