How to Get a Bank Statement Online at The Bank of Baroda?

28 Aug 2023

Table of Content

In today's fast-paced digital landscape, gaining convenient access to your bank statements is an imperative aspect of managing your finances effectively. As a prominent player in the Indian banking realm, Bank of Baroda offers a range of hassle-free methods to obtain e-statements. In this comprehensive blog post, we'll delve into four distinct avenues that enable you to effortlessly acquire your BOB e-statements:

Option 1: Internet Banking

Bank of Baroda provides an intuitive Internet banking platform that enables customers to access their account information and perform various banking activities online. To get your e-statement through internet banking, follow these steps:

1. Log in to your Bank of Baroda internet banking account.

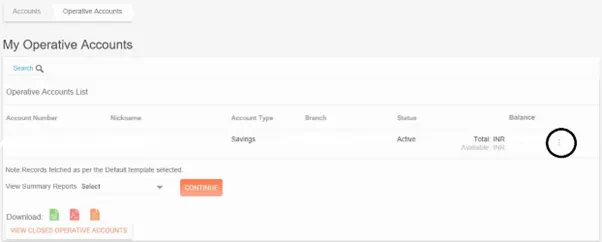

2. Navigate to Operative Accounts under Accounts Tab

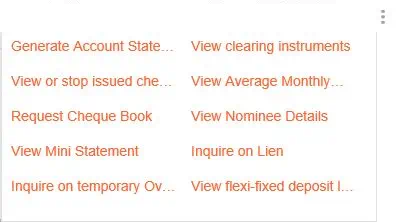

3. Click on the "Three Dots" on the right end of the account for which statement is to be generated.

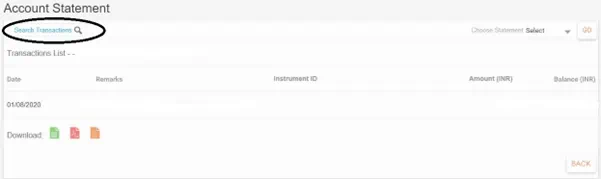

4. Select the "Generate Account Statement" option to access the Account Statement page.

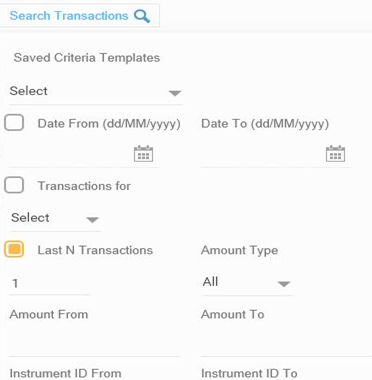

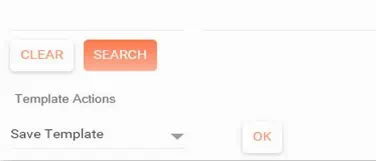

5. Click on the "Search Transactions" link, which will open a search dialog box.

6. Enter the desired criteria, such as the date range, account number, etc., and click on the "Search" button.

7. Once the desired transactions are displayed, you can download the statement in formats like Excel, PDF, or TXT by clicking on the respective icons.

8. Alternatively, you can view the transactions directly by using the navigation or display options available.

Option 2: BOB World App

Bank of Baroda's BOB World app provides a user-friendly interface for accessing banking services on mobile devices. Here's how you can obtain your e-statement through the BOB World app:

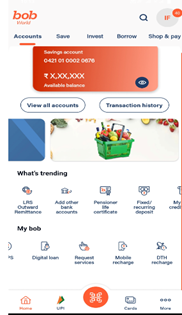

1. Log in to the BOB World app.

2. Select the "Request Services" option from the "More" tab or the "My bob" tab on the home page.

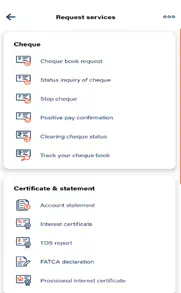

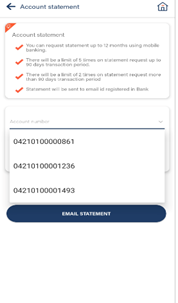

3. Navigate to the "Certificate & Statement" option in the "Request Services" menu and choose "Account Statement."

4. Choose the relevant account number for which you require the statement.

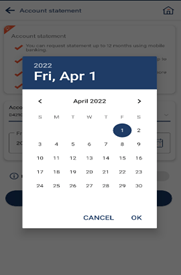

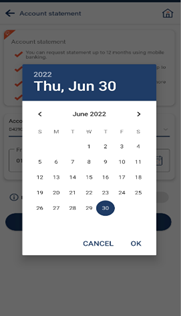

5. Select the "From Date" and "To Date" to specify the desired statement period.

6. Click the "Submit" button to request the statement.

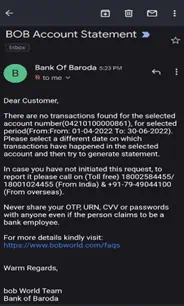

7. A notification reading, "Email sent successfully," will be shown.

8. Shortly after, you will receive an email from Bank of Baroda containing a password-protected PDF file of your e-statement.

Option 3: Visiting Bank Branches

If you prefer an in-person approach, you can visit your nearest Bank of Baroda branch to obtain your statement. The bank's staff will assist you in the process and provide you with a physical or digital copy of your statement as per your preference.

Option 4: Email

Bank of Baroda offers the convenience of receiving your e-statements directly via email. To set up this service, you need to visit your bank base branch and provide your email address for statement delivery. Once activated, you will receive your account statements securely in your inbox at regular intervals.

Conclusion :

Accessing your Bank of Baroda e-statement is now easier than ever, thanks to the multiple options available. Whether you choose to use internet banking, the BOB World app, visit a bank branch, or receive statements via email, Bank of Baroda strives to provide a seamless and convenient banking experience. Choose the method that suits you best and stay on top of your finances with easy access to your account statements.

Popular Articles

Tag Clouds

Related Articles

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.

Complete Guide on Credit Cards

Credit cards are a great way to manage your finances and build credit. With the right strategy, you can use them to pay for purchases, earn rewards, and even get cashback. In this article, we’ll cover everything you need to know about credit cards – from the basics of how they work and how to apply for one, to building your credit score and using rewards programs. Let us understand what is the meaning of a credit card.

What Are The Types of Internet Banking?

The arrival of internet banking has transformed the way one manages their finances. It has revolutionized the banking sector. Customers can now access their bank accounts from the comfort of their homes or offices.