Step by Step Guide on How to Calculate Home Loan EMI

02 Jan 2023

Table of Content

Those who do not have a home to call their own, dream of buying a home. Those who own a home, dream of getting a bigger one. While those who own more than one home in one city, dream of owning homes in other cities too. Then there are dreams of country houses, duplex apartments and villas, the list is endless. But for a first-time homeowner, purchasing a home is fraught with doubts and uncertainties. Home loans are the most feasible option, but not everyone knows how to calculate home loan EMI. The challenges of long-time loan burden discourage many. In today’s age, home loans are a blessing for those who are seriously planning to purchase a home. All you need is willingness, preparation for taking a loan and planning out a way with information and knowledge on managing the monthly instalments while keeping yourself safe from pitfalls. A home is a necessity and with help from home loans, as Marissa Mayer says, even if you can’t have everything you want, you can have the things that matter to you.

Home Loan EMI Calculation

Before availing of a home loan your planning should include your loan-paying capacity while balancing your finances. When you calculate in advance the monthly outgo you can plan the rest of your spending better. Do this before you approach a bank as they will only give you a loan looking at your repaying capacity and you can verify the calculation that the bank puts up. The checks for repayment are planned which helps to secure the tenure of repaying the home loan in its course.

The repayment includes the principal sum and the interest. The payment is made monthly through equated monthly instalments, (EMI).

The Equated Monthly Instalments (EMI) includes two components

Principal Loan amount: The loan amount you have applied for and is disbursed to you.

Loan Interest: The cost added for borrowing the amount that keeps adding through the repayment tenure.

The fundamental of the EMI amount is based on these factors, however, the tenure of repayment you choose determines the EMI size.

Repaying the loan in a shorter duration increases the EMI value but you can save on the interest outflow. Stretching the EMI to a longer tenure makes the EMI easier to manage, but the interest or the borrowing cost keeps adding on. So, the choice of EMI should be based on your financial standing, repayment capacity, and future goals. Fix the repayment tenure accordingly.

So how to calculate EMI for a housing loan?

There is a three-way process of home loan EMI calculation formula, that informs individuals on how to calculate home loan EMI.

There is a simple mathematical formula. You can calculate by just fixing the numbers in the formula to get the right sum.

You can also calculate by using an excel sheet.

You will find online EMI calculators that will help to calculate your EMIs.

Home loan EMI calculation formula

Let us begin with the first, mathematical formula that calculates your EMIs for you.

Formula: EMI = P x R x [{(1 + R)^N} / {1 – (1+R)^N}]

Where,

P stands for the principal loan

R stands for your monthly interest rate [(annual rate/12)/100]

N stands for the total number of months during the loan tenure.

Check this example for a clearer understanding:

Say X took a loan of Rs 60 lakhs at an interest rate of 8.50 per cent. The loan tenure is 20 years. How to calculate home loan EMI?

R = [(annual rate /12)/100]= (8.5/12)/100= 0.70/100= 0.0070N = 240EMI = P x R x [{(1 + R)^N}/{1 – (1+R)^N}]= 60,00,000 x 0.00708333 x [{(1 + 0.00708333)^240}/{1-(1 + 0.00708333^240)}]= 50,00,000 x 0.00708333 x [{5.44123824}/{4.44123824}]= 60,00,000 x 0.00708333 x [1.22516243]EMI = Rs 52,069

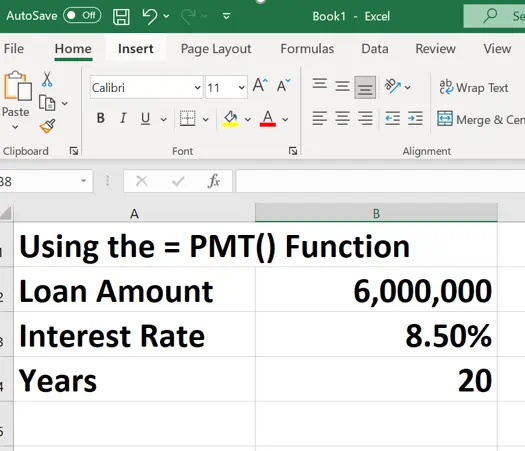

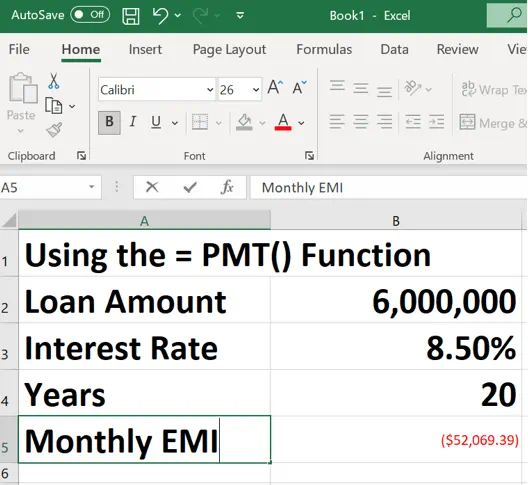

How to calculate home loan EMI on an Excel sheet?

The home loan EMI calculation formula on the Excel sheet helps you to calculate the present value of payments (PMT) which is a simpler way of calculating the EMI.

The formula (r, nper, pv)

Where,

R here stands for rate of interest (8.50 per cent)

NPER stands for the number of months over which the money has to be paid. (240 months)

PV stands for the present value of the loan, meaning the principal amount (Rs 60,00,000).

The Stepwise Process:

The first key in loan amount is the interest rate and the tenure in years.

Don't forget to mention the currency and while logging the interest rate, add the percentage sign. You can also mention the term in years here.

Now key in the formula, PMT= r, nper, pv. The loan tenure needs to be keyed in every month

=PMT(8.5%/12,240,6000000)

After pressing Enter you get the payable EMI value

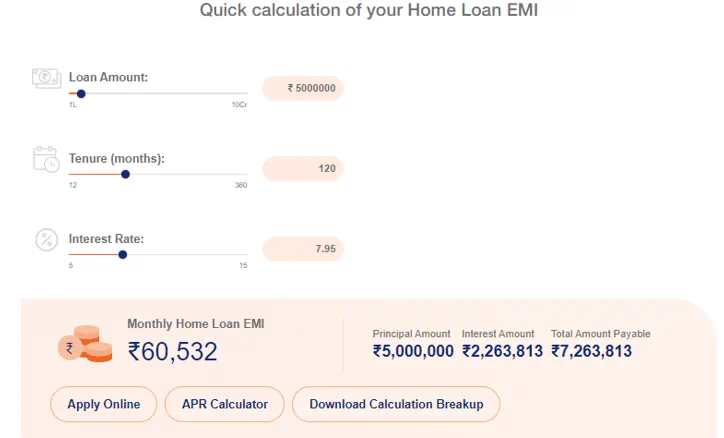

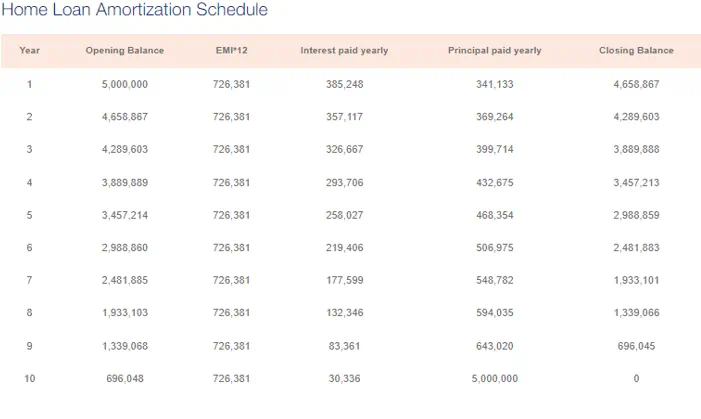

How to calculate EMI for housing loans using the online EMI calculator?

Online EMI calculators are readily available by banks and financial institutes. Enabling easy user-friendly calculations, you just key in the loan amount, interest rate and loan tenure. The tool helps you get a precise breakup of the loan.

Benefits of calculating home loan EMI

Once you get a complete calculation of the home loan EMI, it helps you to get a view of what you are embarking on. The figures help in calculating making additions or subtractions to the principal sum based on your capacity for repayment. So, what are the Benefits of calculating home loan EMI in short?

- You can choose a home loan amount according to your comfort

- The amount that helps you manage your EMIs better

- The amount that doesn't strain your financial balance

Conclusion

Whatever may be your EMIs, this is one task that all home loan seekers should follow. Once you know the monthly expenses you are looking at, your EMIs will not press on your regular financial plans. So even before you apply for a home loan with a bank or any financial institution, you have a clear and calculated sheet that gives you an insight into what your loan repayment entails. Once you learn how to calculate EMI for a housing loan, you can compare the best deal and start paying it off at your convenience.

Popular Articles

What's the Difference Between a Gold Loan and a Loan Against Property?

Related Articles

Guide to Getting Agriculture Loan: Application, Eligibility & Required Documents

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.

A Complete Guide to Home Loan

For those looking to own a home, banks and other financial institutions offer loans for that purpose at competitive interest rates. So if you already have that dream house in sight, the next step isn't too hard.

CIBIL Score for Home Loan - Impact of Credit Score on Home Loan

Are you looking for information on CIBIL score for home loans? Have you been wondering what is the minimum CIBIL score for home loans and how you can bring your credit score within that range? If so, then you’ve landed on the right page! Continue reading the article to know all there is about CIBIL score for housing loan application.

Established in 2000, the Credit Information Bureau Limited (CIBIL) is a credit information company that maintains records of individuals and organisations. A lending agency/company/bank gives out loans on the basis of the CIBIL score generated.

What is the relevance of CIBIL Score for home loan?

The CIBIL score is basically a three-digit number that ranges between 300 and 900. The higher the score, the greater are your chances of getting a home loan easily. Lenders mandatorily check your credit score to know your creditworthiness when you apply for a home loan.

Here is a quick look at how the CIBIL score impacts your home loan application:

● The CIBIL score is essentially the first impression that your lender gets of you as a borrower

● Borrowers applying for home loans with low CIBIL scores might face a harder time in getting their applications approved

● Having a good or high CIBIL score allows you to get the better interest rate

Can a good CIBIL score help you get a home loan at a lower EMI?

Having a good CIBIL score when you apply for a home loan not only makes you eligible to get one but also helps you get funding at a lower interest rate. Lower EMIs will help bring down the overall cost of your housing loan. As we all know, a home loan is long term debt that runs into decades. So, even a small reduction in interest can see you potentially save lakhs of rupees.

Thus, having a higher CIBIL score can prove to be immensely helpful for a housing loan.

What is considered to be a good CIBIL score for home loan applicants?

Generally higher CIBIL score is considered good. It increases chances of getting easy approvals and better rates of interest. Bank of Baroda requires a minimum credit score of 701 for a customer to be eligible for a home loan.

Want to know how to increase your home loan eligibility?

Here are a few tips that can enhance your chances of getting a home loan:

● Paying off existing loans:

This is the major tip which will help you increase your chances of getting your home loan sanctioned. Ensure that you are paying your existing EMIs on time regularly and there is no default. If you have a habit of using your credit card, make sure you pay off your entire card debt on a regular basis so that you don’t have to pay any interest on those expenses. In short, pay the whole balance and not just the minimum due.

● Record your variable pay:

Another way to increase your eligibility is by giving the bank proof of your variable pay apart from submitting your income documents.

● Opt for a joint home loan:

You can add your close relatives as co-applicant, while reviewing an application for a joint home loan, the lender considers the income of both the parties. Hence, a combined monthly income will appear higher and increase your chances of getting the loan value you need.

Quick tip: You can use an online tool called the Home Loan EMI Calculator to understand what your monthly payments will look like for a certain loan amount. Knowing what kind of EMIs you can expect will help you plan your finances better. This will save you from defaulting on your payments and help you keep your credit score in good standing throughout the tenure of your home loan.

Steps to check your CIBIL score online

These days, we have become accustomed to the new normal of doing as many things as possible online, from transferring money to someone to applying for cards and opening bank accounts too. In the same way you also check your CIBIL score digitally!

Simply follow these quick steps to easily check your credit score online:

Step 1 - Go to the official CIBIL website, log in and select “Know Your Score”

Step 2 - Fill up the digital form that appears and enter relevant details such as your name, date of birth, past loan history, ID proof etc.

Step 3 - After the form has been properly filled, a payment page will appear. You can choose your preferred form of payment method like debit/credit cards or net banking.

Step 4 - After successful payment you will have to answer five questions CIBIL asks about your credit history, out of which three need to be correct, in order to get your identity authenticated from CIBIL.

On approval, you will get your credit report mailed to you in the next 24 hours, and you can check your CIBIL score, also existing BOB customer can check their CIBIL score through bob World mobile banking app.

Conclusion

Now you can be the proud owner of your very own dream home with the easy home loan options given by Bank of Baroda. Our home loans have low interest rates, affordable processing fees, and longer tenures too. At Bank of Baroda, you can also enjoy many other benefits such as a free credit card when you apply for a home loan. Choose from our wide range of home loans including pre-approved home loan, home improvement loan, and loan takeover scheme, among others. You can check your home loan eligibility online on our website and even apply for your home loan online too. It’s that convenient!

Get in touch with us today to know more.