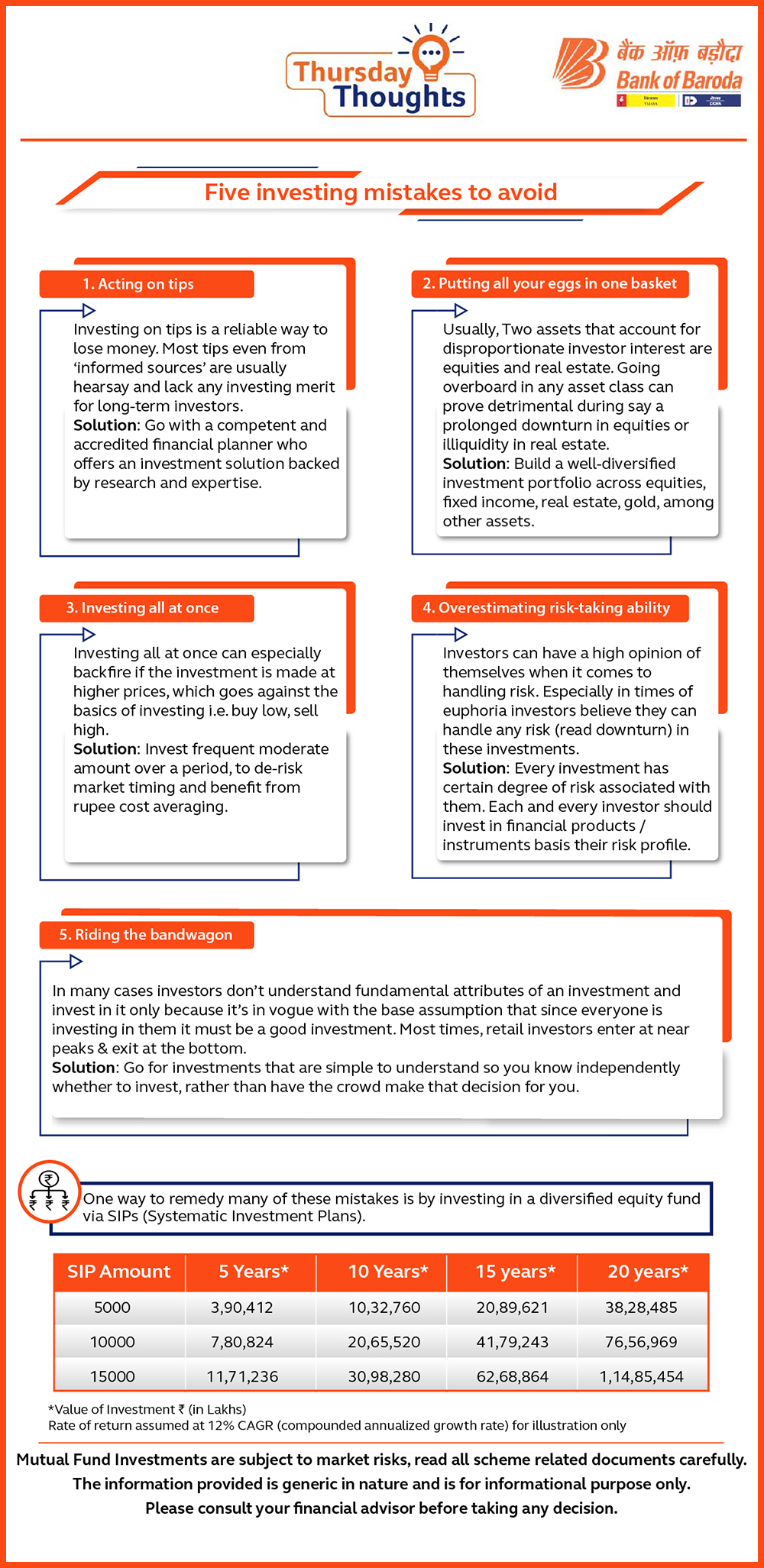

5 Common investing mistakes to avoid

07 Jun 2022

1. Acting on tips

Investing on tips is a reliable way to lose money. Most tips even from ‘informed sources’ are usually hearsay and lack any investing merit for long-term investors.

Solution: Go with a competent and accredited financial planner who offers an investment solution backed by research and expertise.

2. Riding the bandwagon

In many cases investors don’t understand fundamental attributes of an investment and invest in it only because it’s in vogue with the base assumption that since everyone is investing in them it must be a good investment. Most times, retail investors enter at near peaks & exit at the bottom.

Solution: Go for investments that are simple to understand so you know independently whether to invest, rather than have the crowd make that decision for you.

3. Investing all at once

Investing all at once can especially backfire if the investment is made at higher prices, which goes against the basics of investing i.e. buy low, sell high.

Solution: Invest frequent moderate amount over a period, to de-risk market timing and benefit from rupee cost averaging.

4. Putting all your eggs in one basket

Usually, two assets that account for disproportionate investor interest are equities and real estate. Going overboard in any asset class can prove detrimental during say a prolonged downturn in equities or illiquidity in real estate.

Solution: Build a well-diversified investment portfolio across equities, fixed income, real estate, gold, among other assets.

5. Overestimating risk-taking ability

Investors can have a high opinion of themselves when it comes to handling risk. Especially in times of euphoria investors believe they can handle any risk (read downturn) in these investments.

Solution: Every investment has certain degree of risk associated with them. Each and every investor should invest in financial products/instruments basis their risk profile.

One way to remedy many of these mistakes is by investing in a diversified equity fund via SIPs (Systematic Investment Plans).

| SIP Amount | 5 Years* | 10 Years* | 15 years* | 20 years* |

|---|---|---|---|---|

| 5000 | 3,90,412 | 10,32,760 | 20,89,621 | 38,28,485 |

| 10000 | 7,80,824 | 20,65,520 | 41,79,243 | 76,56,969 |

| 15000 | 11,71,236 | 30,98,280 | 62,68,864 | 1,14,85,454 |

*Value of Investment ` (in Lakhs)

Rate of return assumed at 12% CAGR (compounded annualized growth rate) for illustration only

Popular Infographics

Tag Clouds

Related Infographics

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.