Five golden rules Of Investing

05 Jan 2023

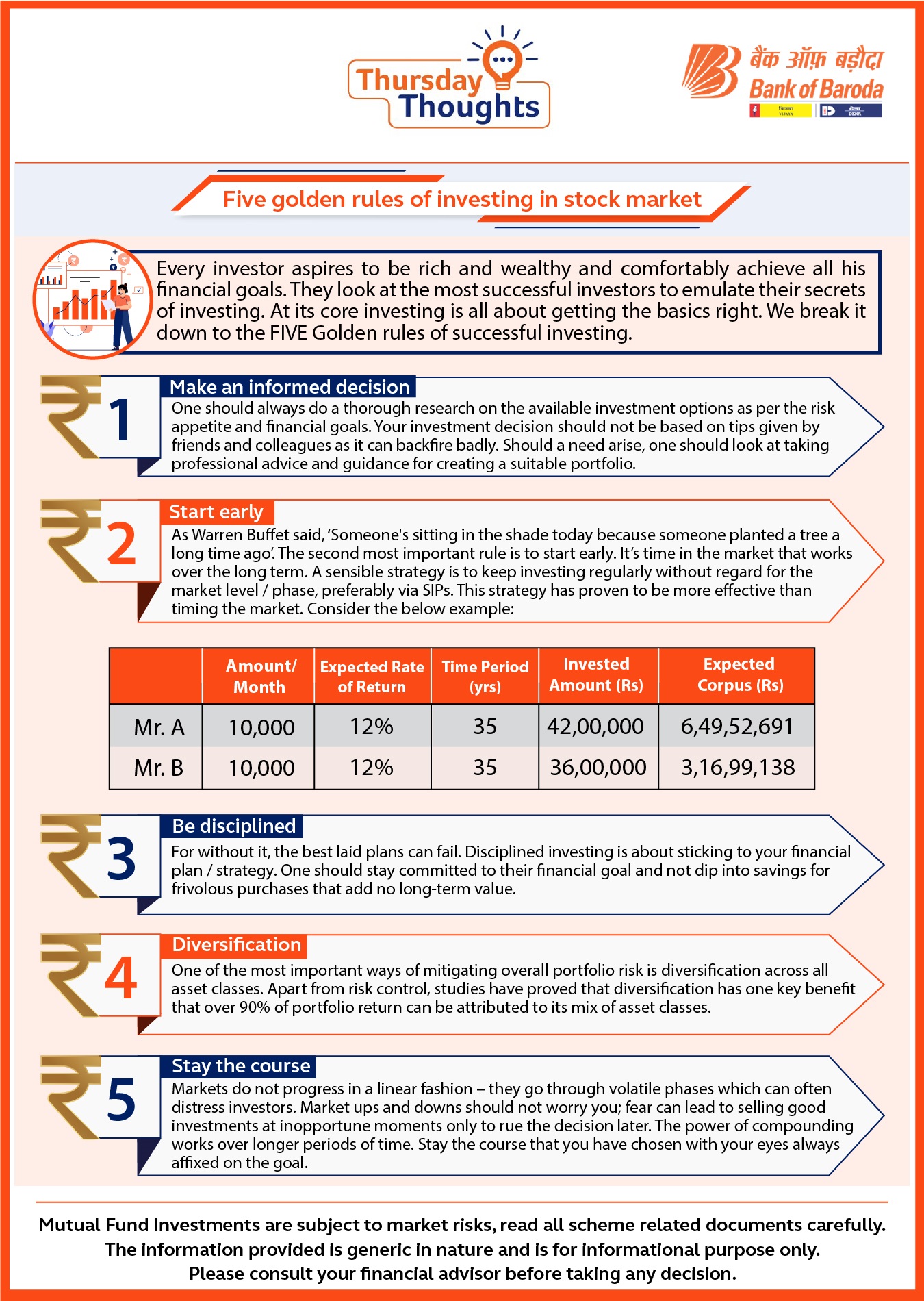

Every investor aspires to be rich and wealthy and comfortably achieve all his financial goals. They look at the most successful investors to emulate their secrets of investing. At its core investing is all about getting the basics right. We break it down to the FIVE Golden rules of successful investing.

- Make an informed decision

One should always do a thorough research on the available investment options as per the risk appetite and financial goals. Your investment decision should not be based on tips given by friends and colleagues as it can backfire badly. Should a need arise, one should look at taking professional advice and guidance for creating a suitable portfolio.

- Start early

As Warren Buffet said, ‘Someone's sitting in the shade today because someone planted a tree a long time ago’. The second most important rule is to start early.It’s time in the market that works over the long term. A sensible strategy is to keep investing regularly without regard for the market level / phase, preferably via SIPs. This strategy has proven to be more effective than timing the market. Consider the below example:

Assuming the retirement age is 60 years, Mr. A at the age of 25 starts an SIP of Rs 10,000 for a period of 35 yrs v/s Mr. B at the age of 30 years who starts an SIP of Rs 10,000 for a period of 30 yrs. The difference between the expected corpus built is huge.

| Amount/Month | Expected Rate of Return | Time Period (yrs) | Invested Amount (Rs) | Expected Corpus (Rs) | |

| Mr. A | 10000 | 12% | 35 | 42,00,000 | 6,49,52,691 |

| Mr. B | 10000 | 12% | 35 | 36,00,000 | 3,16,99,138 |

- Be disciplined

For without it, the best laid plans can fail. Disciplined investing is about sticking to your financial plan / strategy. One should stay committed to their financial goal and not dip into savings for frivolous purchases that add no long-term value.

- Diversification

One of the most important ways of mitigating overall portfolio risk is diversification across all asset classes. Apart from risk control, studies have proved that diversification has one key benefit that over 90% of portfolio return can be attributed to its mix of asset classes.

- Stay the course

Markets do not progress in a linear fashion – they go through volatile phases which can often distress investors. Market ups and downs should not worry you; fear can lead to selling good investments at inopportune moments only to rue the decision later. The power of compounding works over longer periods of time. Stay the course that you have chosen with your eyes always affixed on the goal.

Popular Infographics

Tag Clouds

Related Infographics

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.