All About Public Provident Fund (PPF)

02 Mar 2023

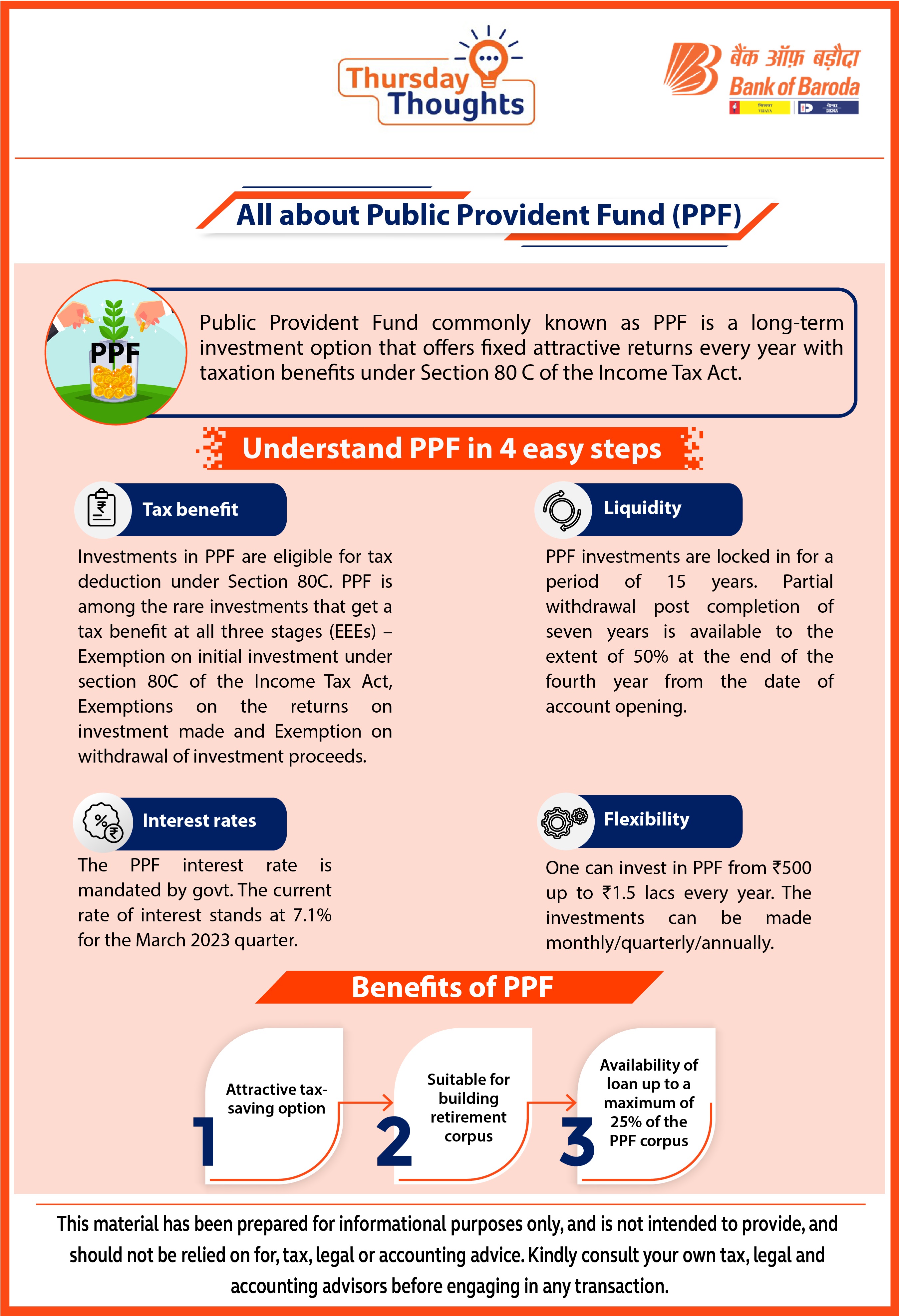

All about Public Provident Fund (PPF)

Public Provident Fund commonly known as PPF is a long-term investment option that offers fixed attractive returns every year with taxation benefits under Section 80 C of the Income Tax Act.

Understand PPF in 5 easy steps

1. Tax benefit

Investments in PPF are eligible for tax deduction under Section 80C. PPF is among the rare investments that get a tax benefit at all three stages (EEEs) –Exemption on initial investment under section 80C of the Income Tax Act, Exemptions on the returns on investment made and Exemption on withdrawal of investment proceeds.

2. Interest rates

The PPF interest rate is mandated by govt . The current rate of interest stands at 7.1 % for financial year 2022-2023.

3. Liquidity

PPF investments are locked in for a period of 15 years. Partial withdrawal post completion of seven years is available to the extent of 50 % at the end of the fourth year from the date of account opening.

4. Flexibility

One can invest in PPF from INR 500 upto INR 1.5 lacs every year. The investments can be made monthly/quarterly and annually.

Benefits of PPF

- Attractive tax-saving option

- Suitable for building retirement corpus

- Availability of loan upto a maximum of 25% of the PPF corpus

Popular Infographics

Tag Clouds

Related Infographics

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.