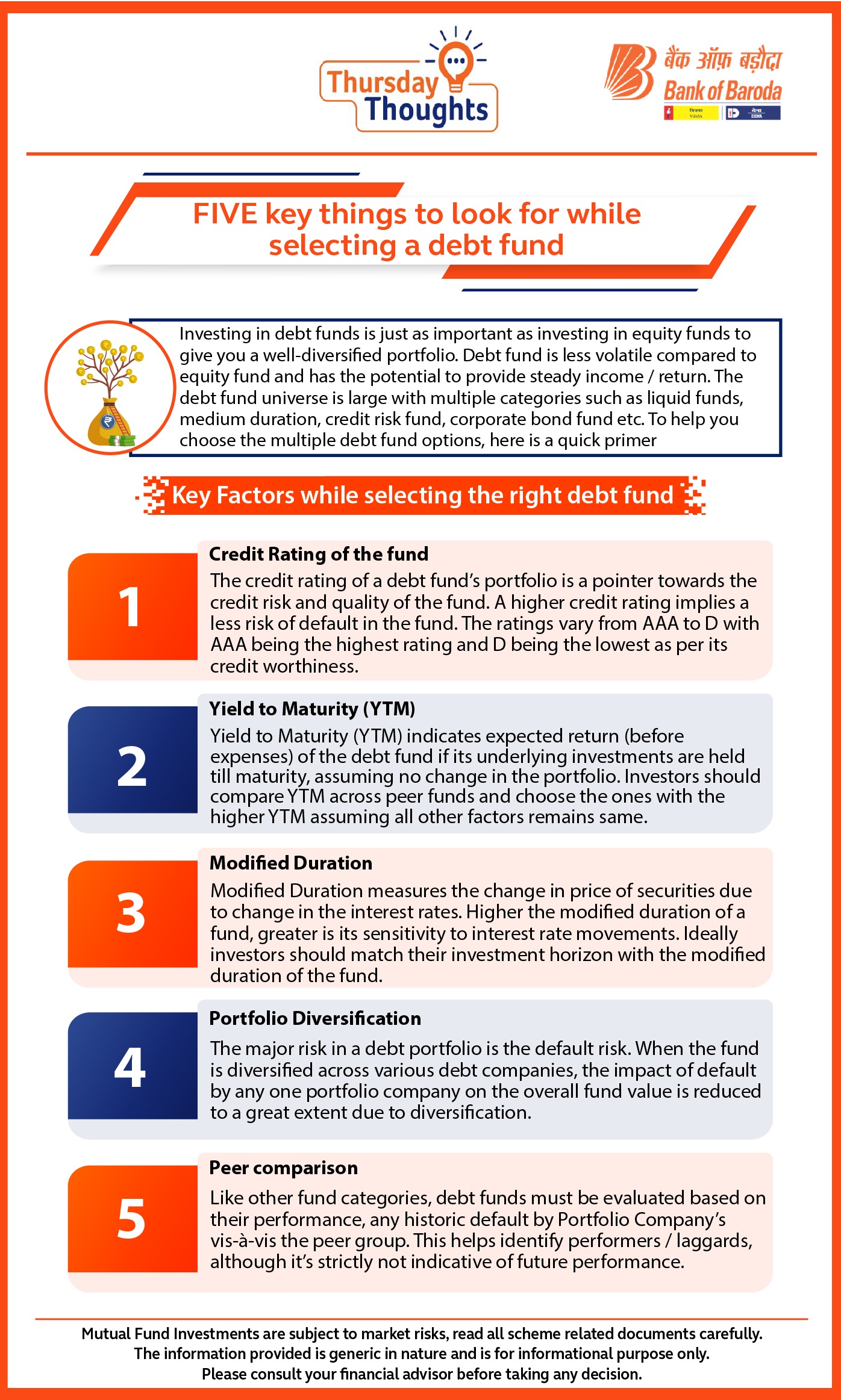

FIVE Key Things to Look For While Selecting a Debt Fund

08 Dec 2022

Investing in debt funds is just as important as investing in equity funds to give you a well-diversified portfolio. Debt fund is less volatile compared to equity fund and has the potential to provide steady income / return.

The debt fund universe is large with multiple categories such as liquid funds, medium duration, credit risk fund, corporate bond fund etc. To help you choose the multiple debt fund options, here is a quick primer.

Key Factors while selecting the right debt fund

1. Credit Rating of the fund

The credit rating of a debt fund’s portfolio is a pointer towards the credit risk and quality of the fund. A higher credit rating implies a less risk of default in the fund. The ratings vary from AAA to D with AAA being the highest rating and D being the lowest as per its credit worthiness.

2. Yield to Maturity (YTM)

Yield to Maturity (YTM) indicates expected return (before expenses) of the debt fund if its underlying investments are held till maturity, assuming no change in the portfolio. Investors should compare YTM across peer funds and choose the ones with the higher YTM assuming all other factors remains same.

3. Modified Duration

Modified Duration measures the change in price of securities due to change in the interest rates. Higher the modified duration of a fund, greater is its sensitivity to interest rate movements. Ideally investors should match their investment horizon with the modified duration of the fund.

4. Portfolio Diversification

The major risk in a debt portfolio is the default risk. When the fund is diversified across various debt companies, the impact of default by any one portfolio company on the overall fund value is reduced to a great extent due to diversification.

5. Peer comparison

Like other fund categories, debt funds must be evaluated based on their performance, any historic default by Portfolio Company’s vis-à-vis the peer group. This helps identify performers / laggards, although it’s strictly not indicative of future performance.

Popular Infographics

Tag Clouds

Related Infographics

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.