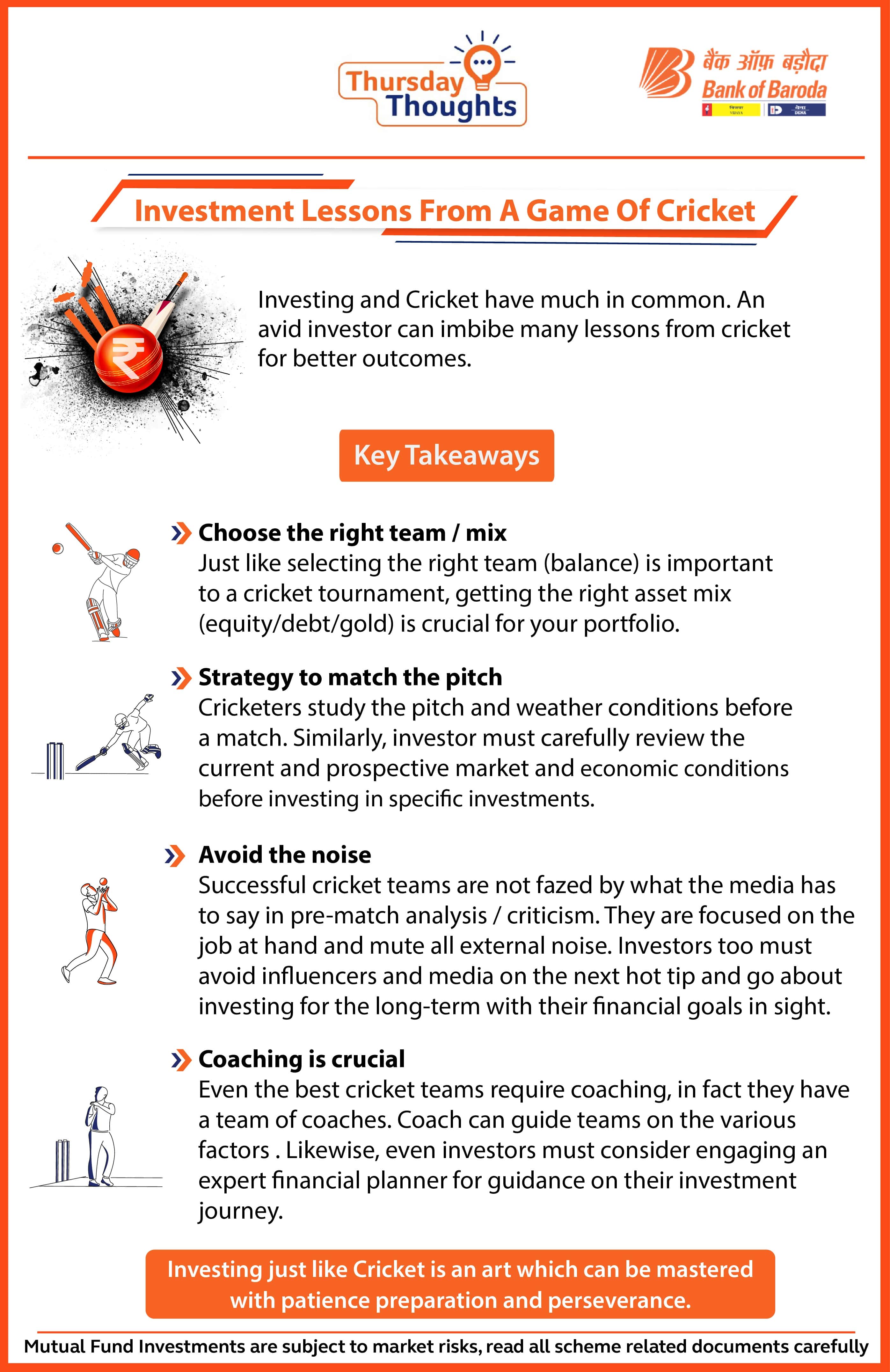

Investment Lessons From A Game Of Cricket

15 Jun 2023

Investing and Cricket have much in common. An avid investor can imbibe many lessons from cricket for better outcomes.

Key Takeaways

Choose the right team / mix

Just like selecting the right team (balance) is important to a cricket tournament, getting the right asset mix (equity/debt/gold) is crucial for your portfolio.

Strategy to match the pitch

Cricketers study the pitch and weather conditions before a match. Similarly, investor must carefully review the current and prospective market and economic conditions before investing in specific investments.

Avoid the noise

Successful cricket teams are not fazed by what the media has to say in pre-match analysis / criticism. They are focused on the job at hand and mute all external noise. Investors too must avoid influencers and media on the next hot tip and go about investing for the long-term with their financial goals in sight.

Coaching is crucial

Even the best cricket teams require coaching, in fact they have a team of coaches. Coach can guide teams on the various factors . Likewise, even investors must consider engaging an expert financial planner for guidance on their investment journey.

Investing just like Cricket is an art which can be mastered with patience preparation and perseverance.

Popular Infographics

Tag Clouds

Related Infographics

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.