Why Target Maturity Funds Make Sense

15 Dec 2022

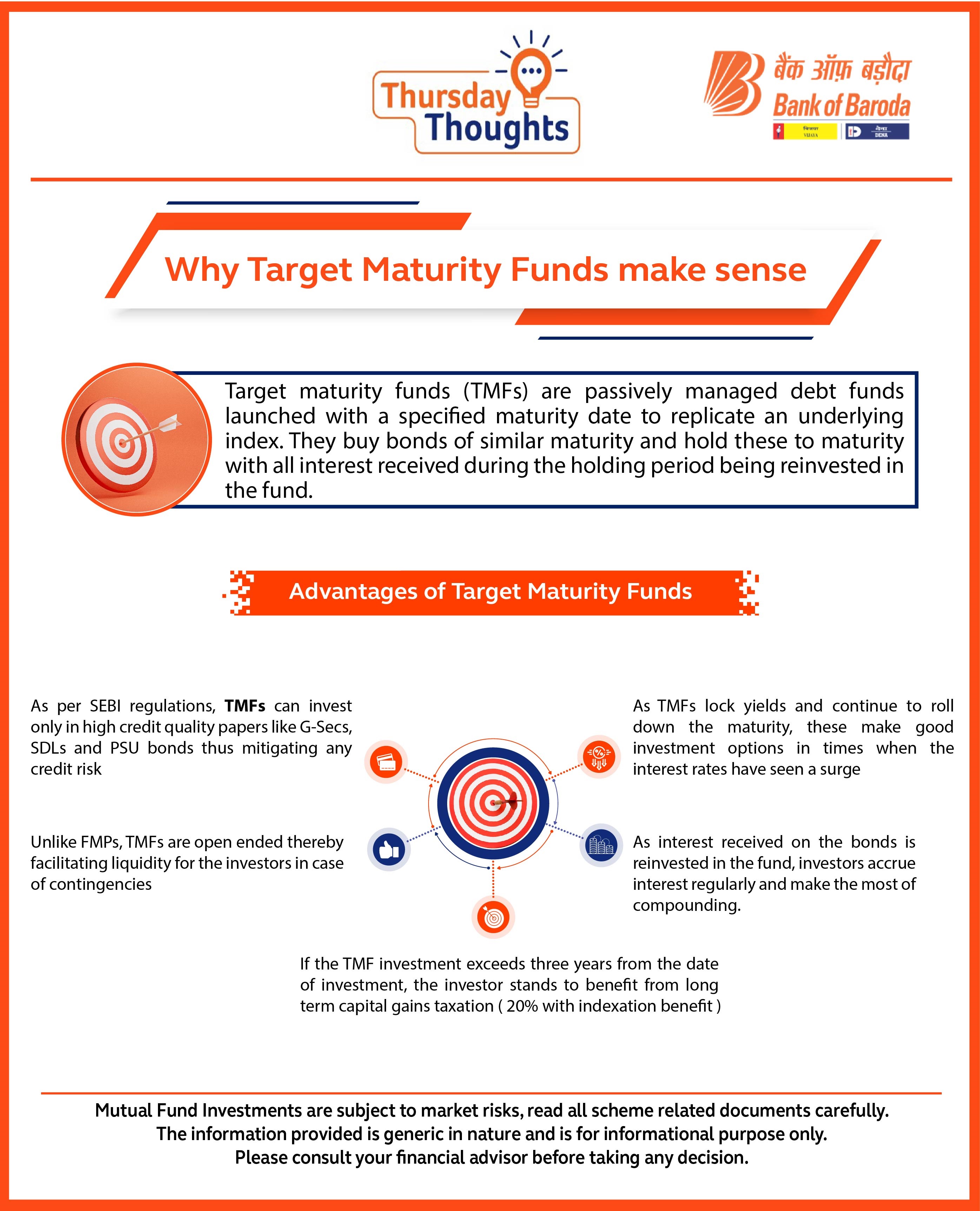

Target maturity funds (TMFs) are passively managed debt funds launched with a specified maturity date to replicate an underlying index. They buy bonds of similar maturity and hold these to maturity with all interest received during the holding period being reinvested in the fund.

- As per SEBI regulations, TMFs can invest only in high credit quality papers like G-Secs, SDLs and PSU bonds thus mitigating any credit risk

- Unlike FMPs, TMFs are open ended thereby facilitating liquidity for the investors in case of contingencies

- If the TMF investment exceeds three years from the date of investment, the investor stands to benefit from long term capital gains taxation ( 20% with indexation benefit )

- As interest received on the bonds is reinvested in the fund, investors accrue interest regularly and make the most of compounding.

- As TMFs lock yields and continue to roll down the maturity, these make good investment options in times when the interest rates have seen a surge

Popular Infographics

Tag Clouds

Related Infographics

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.