The 40% EMI Mantra

20 Oct 2022

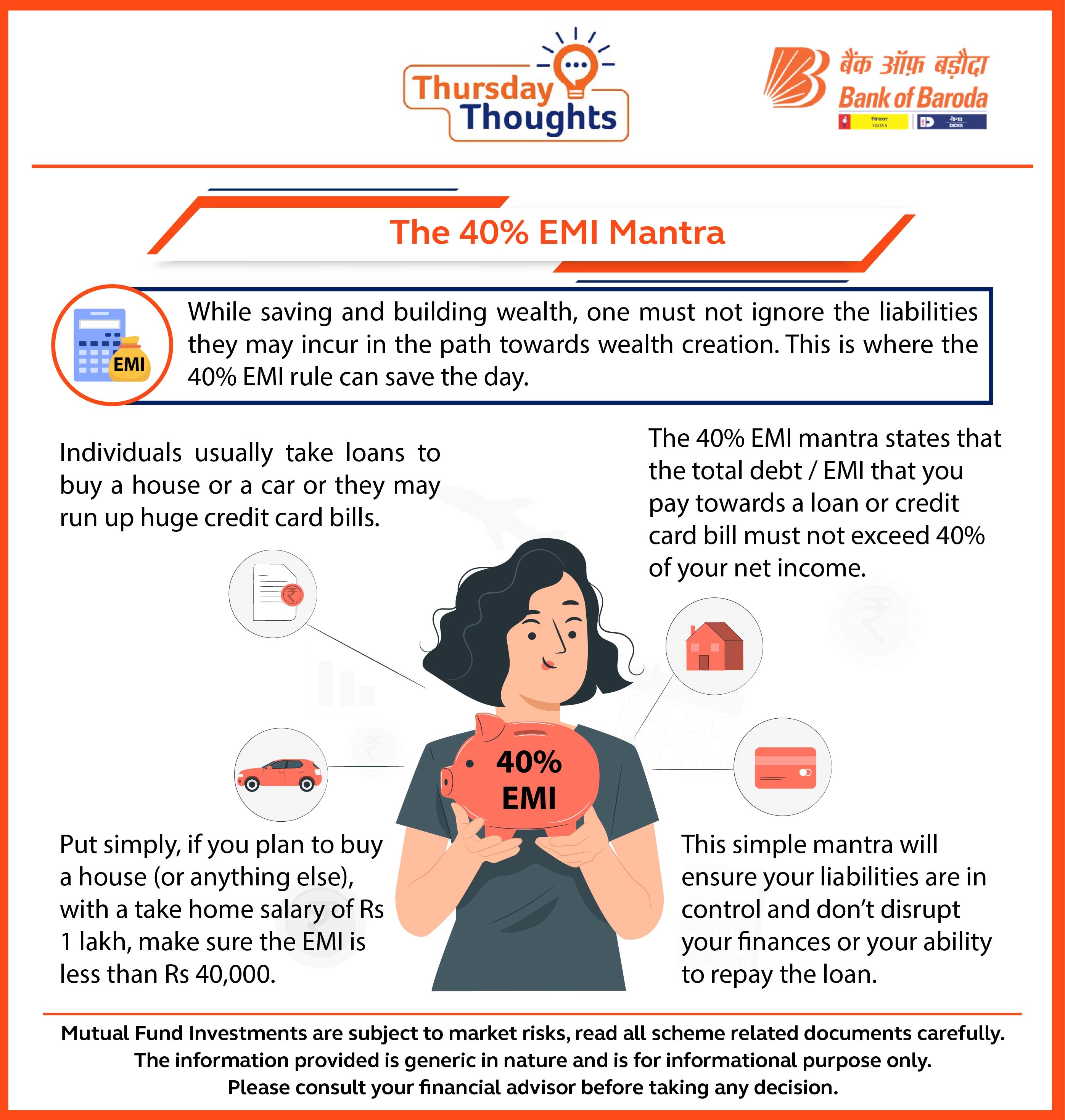

While saving and building wealth, one must not ignore the liabilities they may incur in the path towards wealth creation. This is where the 40% EMI rule can save the day.

Individuals usually take loans to buy a house or a car or they may run up huge credit card bills.

The 40% EMI mantra states that the total debt / EMI that you pay towards a loan or credit card bill must not exceed 40% of your net income.

Put simply, if you plan to buy a house (or anything else), with a take home salary of Rs 1 lakh, make sure the EMI is less than Rs 40,000.

This simple mantra will ensure your liabilities are in control and don’t disrupt your finances or your ability to repay the loan.

Popular Infographics

Tag Clouds

Related Infographics

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.

Leave a Comment

Thanks for submitting your details.