5 Things to do in a Volatile Market

21 Jul 2022

1. Focus on long-term

It is normal to feel negative during period of volatility or downturn, however one should focus on the long-term wealth creation and stay invested.

2. Diversify

Diversifying your portfolio across different Asset class such as Equity, Debt, Gold etc is key to reduce volatility in your portfolio and smoothen your ride during a turbulent market.

3. Review & maintain strict Asset Allocation basis your long-term goals

Reviewing your Asset Allocation mix regularly and rebalancing it back to the target allocation is a prudent and ideal way of leveraging your investment portfolio to achieve your long-term goals

4. Avoid Noise

We are constantly exposed to diverse news and updates on different platforms which may not have any significant long-term impact on your portfolio. Not all information is useful and relevant.

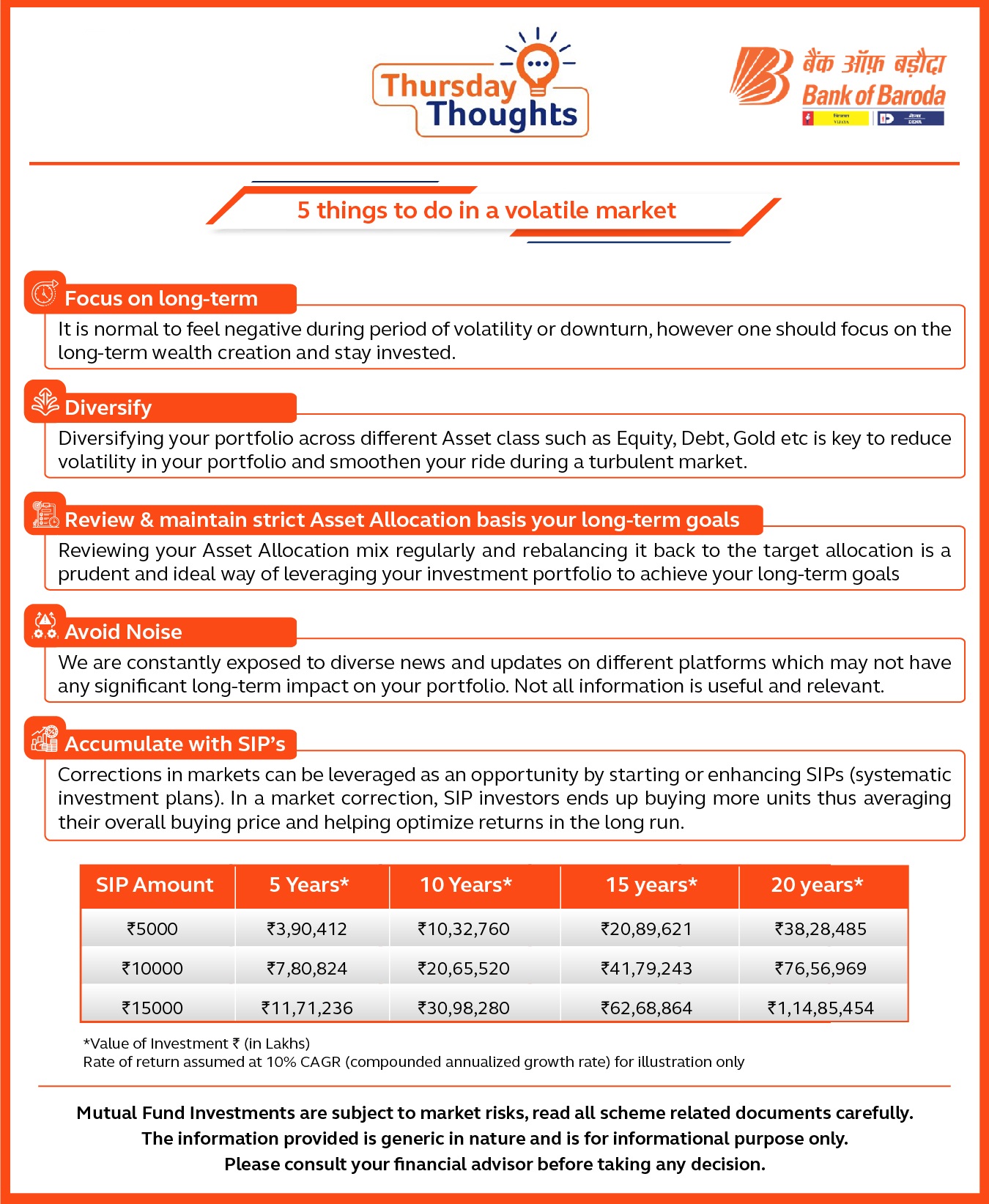

5. Accumulate with SIP’s

Corrections in markets can be leveraged as an opportunity by starting or enhancing SIPs ( systematic investment plans ). In a market correction, SIP investors ends up buying more units thus averaging their overall buying price and helping optimize returns in the long run.

SIP Table

| SIP Amount | 5 Years* | 10 Years* | 15 Years* | 20 years* |

|---|---|---|---|---|

| 5,000 | 3,90,412 | 10,32,760 | 20,89,621 | 38,28,485 |

| 10,000 | 7,80,824 | 20,65,520 | 41,79,243 | 76,56,969 |

| 15,000 | 11,71,236 | 30,98,280 | 62,68,864 | 1,14,85,454 |

* Value of investment (In Rs Lakhs)

Rate of Return assumed at 10% CAGR (Compounded Annual Growth Rate) for illustration purpose only.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. The information provided is generic in nature and is for informational purpose only. Please consult your financial advisor before taking any decision.

Popular Infographics

Tag Clouds

Related Infographics

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.