Step up your SIP Game

07 Jul 2022

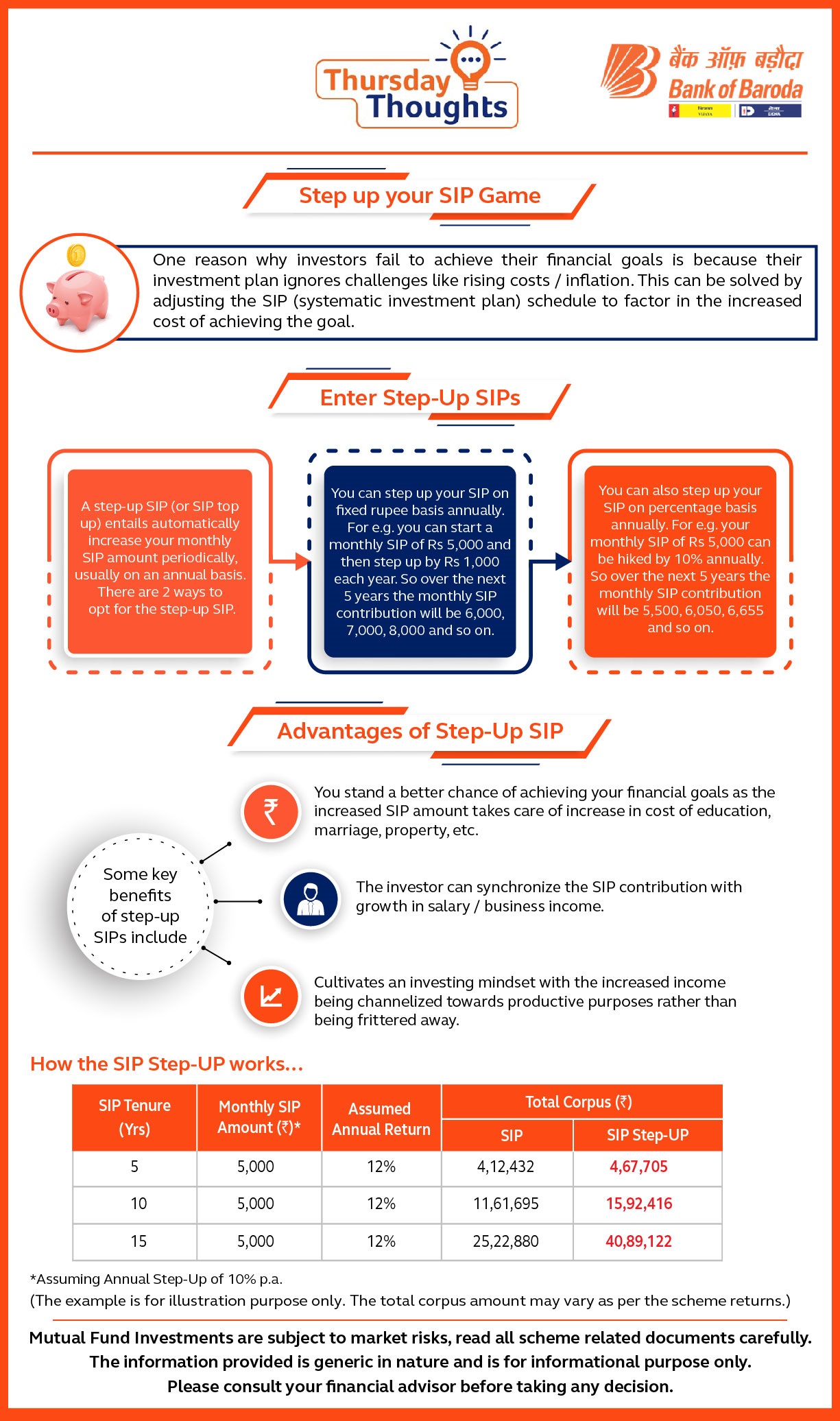

One reason why investors fail to achieve their financial goals is because their investment plan ignores challenges like rising costs / inflation. This can be solved by adjusting the SIP (systematic investment plan) schedule to factor in the increased cost of achieving the goal.

Enter Step-Up SIPs

A step-up SIP (or SIP top up) entails automatically increase your monthly SIP amount periodically, usually on an annual basis. There are 2 ways to opt for the step-up SIP.

You can step up your SIP on fixed rupee basis annually. For e.g. you can start a monthly SIP of Rs 5,000 and then step up by Rs 1,000 each year. So over the next 5 years the monthly SIP contribution will be 6,000, 7,000, 8,000 and so on.

You can also step up your SIP on percentage basis annually. For e.g. your monthly SIP of Rs 5,000 can be hiked by 10% annually. So over the next 5 years the monthly SIP contribution will be 5,500, 6,050, 6,655 and so on.

Advantages of Step-Up SIP

Some key benefits of step-up SIPs include:

- You stand a better chance of achieving your financial goals as the increased SIP amount takes care of increase in cost of education, marriage, property, etc.

- The investor can synchronize the SIP contribution with growth in salary / business income.

- Cultivates an investing mindset with the increased income being channelized towards productive purposes rather than being frittered away.

Illustration

How the SIP Step-Up works...

| SIP Tenure (Yrs.) | Monthly SIP Amount (`)* | Assumed Annual Return | Total Corpus (`) | |

|---|---|---|---|---|

| SIP | SIP Step-Up | |||

| 5 | 5,000 | 12% | 4,12,432 | 4,67,705 |

| 10 | 5,000 | 12% | 11,61,695 | 15,92,416 |

| 15 | 5,000 | 12% | 25,22,880 | 40,89,122 |

*Assuming Annual Step-Up of 10% p.a.

(The example is for illustration purpose only. The total corpus amount may vary as per the scheme returns.)

Mutual funds are subject to Market risks, read all scheme related documents carefully. The information provided is generic in nature and is for informational purpose only. Please consult your financial advisor before taking any decision.

Popular Infographics

Tag Clouds

Related Infographics

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.