Nomination in Financial Planning: Ensure Seamless Asset Transfer with Expert Nomination Strategies

14 Mar 2024

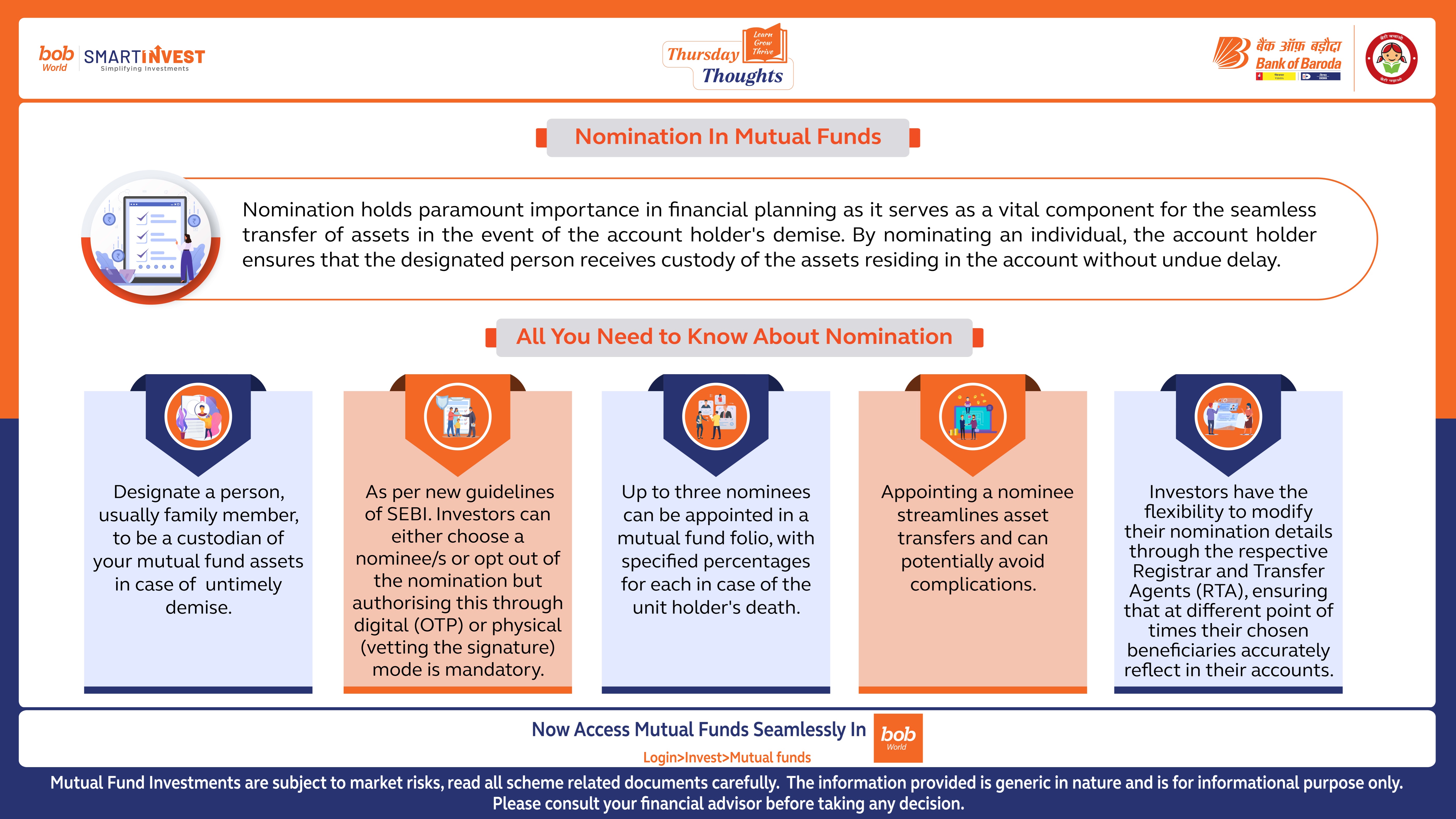

Nomination In Mutual Funds

Nomination holds paramount importance in financial planning as it serves as a vital component for the seamless transfer of assets in the event of the account holder's demise. By nominating an individual, the account holder ensures that the designated person receives custody of the assets residing in the account without undue delay.

All You Need to Know About Nomination

- Designate a person, usually family member, to be a custodian of your mutual fund assets in case of untimely demise.

- As per new guidelines of SEBI. Investors can either choose a nominee/s or opt out of the nomination but authorising this through digital (OTP) or physical (vetting the signature) mode is mandatory.

- Up to three nominees can be appointed in a mutual fund folio, with specified percentages for each in case of the unit holder's death.

- Appointing a nominee streamlines asset transfers and can potentially avoid complications.

- Investors have the flexibility to modify their nomination details through the respective Registrar and Transfer Agents (RTA), ensuring that at different point of times their chosen beneficiaries accurately reflect in their accounts.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. The information provided is generic in nature and is for informational purpose only. Please consult your financial advisor before taking any decision.

Popular Infographics

Related Infographics

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.

Leave a Comment

Thanks for submitting your details.