Crucial Role of Assets in Effective Asset Allocation

21 Mar 2024

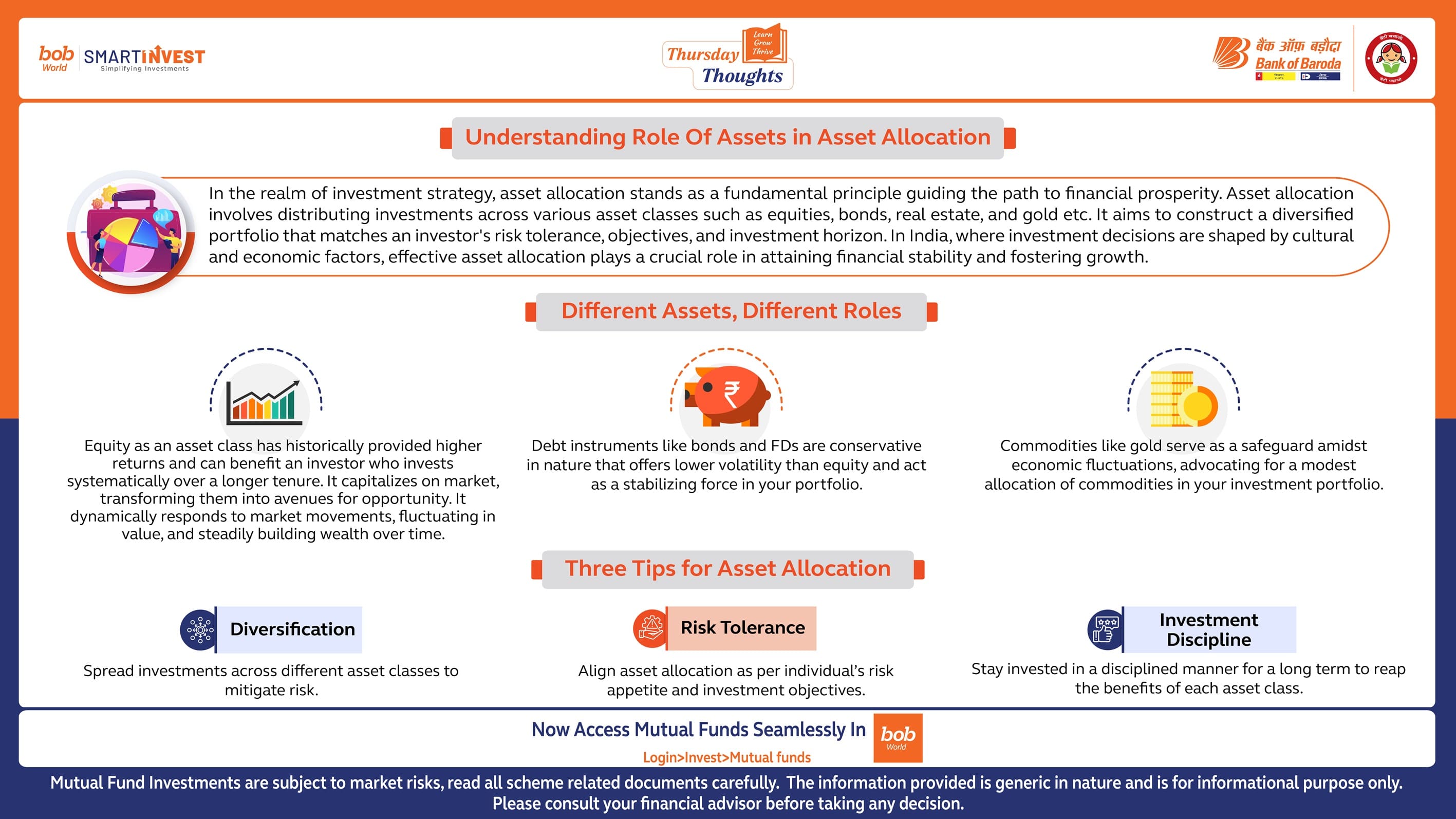

Understanding Role of Assets in Asset Allocation

In the realm of investment strategy, asset allocation stands as a fundamental principle guiding the path to financial prosperity. Asset allocation involves distributing investments across various asset classes such as equities, bonds, real estate, and gold etc. It aims to construct a diversified portfolio that matches an investor's risk tolerance, objectives, and investment horizon. In India, where investment decisions are shaped by cultural and economic factors, effective asset allocation plays a crucial role in attaining financial stability and fostering growth.

Different Assets, Different Roles

Equity as an asset class has historically provided higher returns and can benefit an investor who invests systematically over a longer tenure. It capitalizes on market, transforming them into avenues for opportunity. It dynamically responds to market movements, fluctuating in value, and steadily building wealth over time.

Debt instruments like bonds and FDs are conservative in nature that offers lower volatility than equity and act as a stabilizing force in your portfolio.

Commodities like gold serve as a safeguard amidst economic fluctuations, advocating for a modest allocation of commodities in your investment portfolio.

Three Tips for Asset Allocation

1. Diversification :

Spread investments across different asset classes to mitigate risk.

2. Risk Tolerance :

Align allocation with individual risk preferences and investment objectives.

3. Investment Discipline :

Stay invested in a disciplined manner for a long term to reap the benefits of each asset class.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. The information provided is generic in nature and is for informational purpose only. Please consult your financial advisor before taking any decision.

Popular Infographics

Related Infographics

Nomination in Financial Planning: Ensure Seamless Asset Transfer with Expert Nomination Strategies

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.

Leave a Comment

Thanks for submitting your details.