All About Alternative Investment Funds

04 Apr 2024

All About Alternative Investment Funds

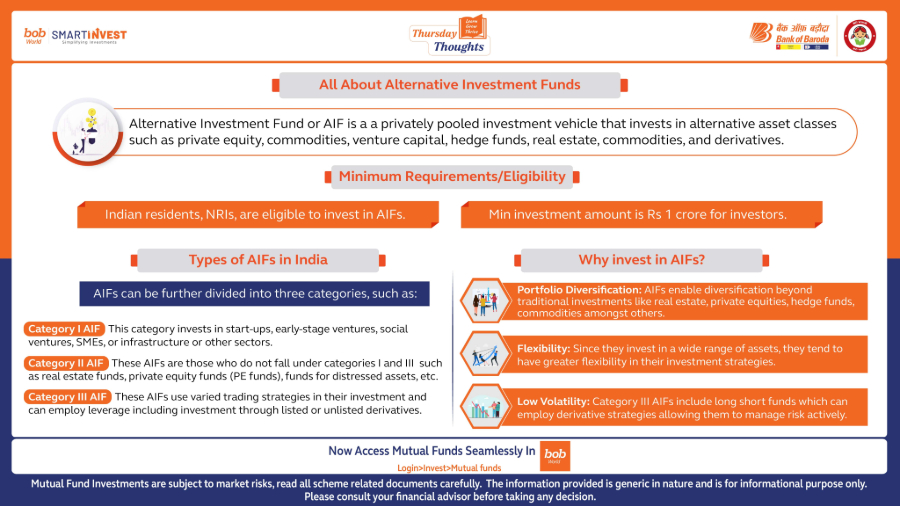

Alternative Investment Fund or AIF is a a privately pooled investment vehicle that invests in alternative asset classes such as private equity, commodities, venture capital, hedge funds, real estate, commodities, and derivatives.

Minimum Requirements/Eligibility

Indian residents, NRIs, are eligible to invest in AIFs.

Min investment amount is Rs 1 crore for investors.

Types of AIFs in India

AIFs can be further divided into three categories, such as:

Category I AIF: This category invests in start-ups, early-stage ventures, social ventures, SMEs, or infrastructure or other sectors.

Category II AIF: These AIFs are those who do not fall under categories I and III such as real estate funds, private equity funds (PE funds), funds for distressed assets, etc.

Category III AIF: These AIFs use varied trading strategies in their investment and can employ leverage including investment through listed or unlisted derivatives.

Why invest in AIFs?

Portfolio Diversification: AIFs enable diversification beyond traditional investments like real estate, private equities, hedge funds, commodities amongst others.

Flexibility: Since they invest in a wide range of assets, they tend to have greater flexibility in their investment strategies.

Low Volatility: Category III AIFs include long short funds which can employ derivative strategies allowing them to manage risk actively.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. The information provided is generic in nature and is for informational purpose only. Please consult your financial advisor before taking any decision.

Popular Infographics

Related Infographics

Nomination in Financial Planning: Ensure Seamless Asset Transfer with Expert Nomination Strategies

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.

Leave a Comment

Thanks for submitting your details.