Decoding Equity SIPs And Mutual Fund SIPs

18 May 2023

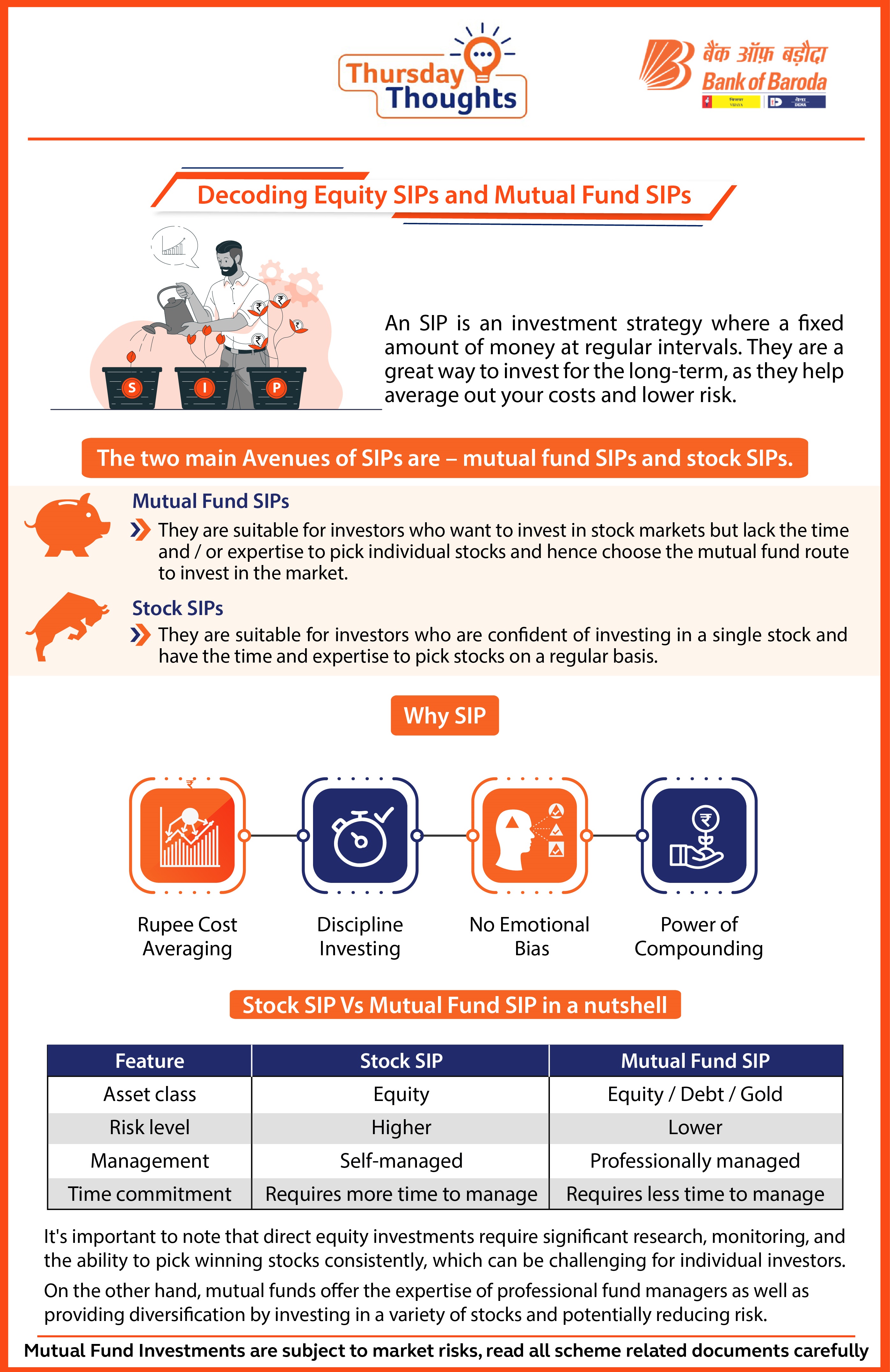

An SIP is an investment strategy where a fixed amount of money at regular intervals. They are a great way to invest for the long-term, as they helpaverage out your costs and lower risk.

The two main Avenues of SIPs are – mutual fund SIPs and stock SIPs.

Mutual Fund SIPs

They are suitable for investors who want to invest in stock markets but lack the time and / or expertise to pick individual stocks and hence choose the mutual fund route to invest in the market.

Stock SIPs

They are suitable for investors who are confident of investing in a single stock and have the time and expertise to pick stocks on a regular basis.

Why SIP

Rupee Cost Averaging

Discipline Investing

No Emotional Bias

Stock SIP Vs Mutual Fund SIP in a nutshell

| Feature | Stock SIP | Mutual Fund SIP |

|---|---|---|

| Asset class | Equity | Equity/Debt/Gold |

| Risk level | Higher | Lower |

| Management | Self-managed | Professionally managed |

| Time commitment | Requires more time to manage | Requires less time to manage |

Popular Infographics

Tag Clouds

Related Infographics

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.