Invest Smartly for Tax Benefits with ELSS

25 Jan 2024

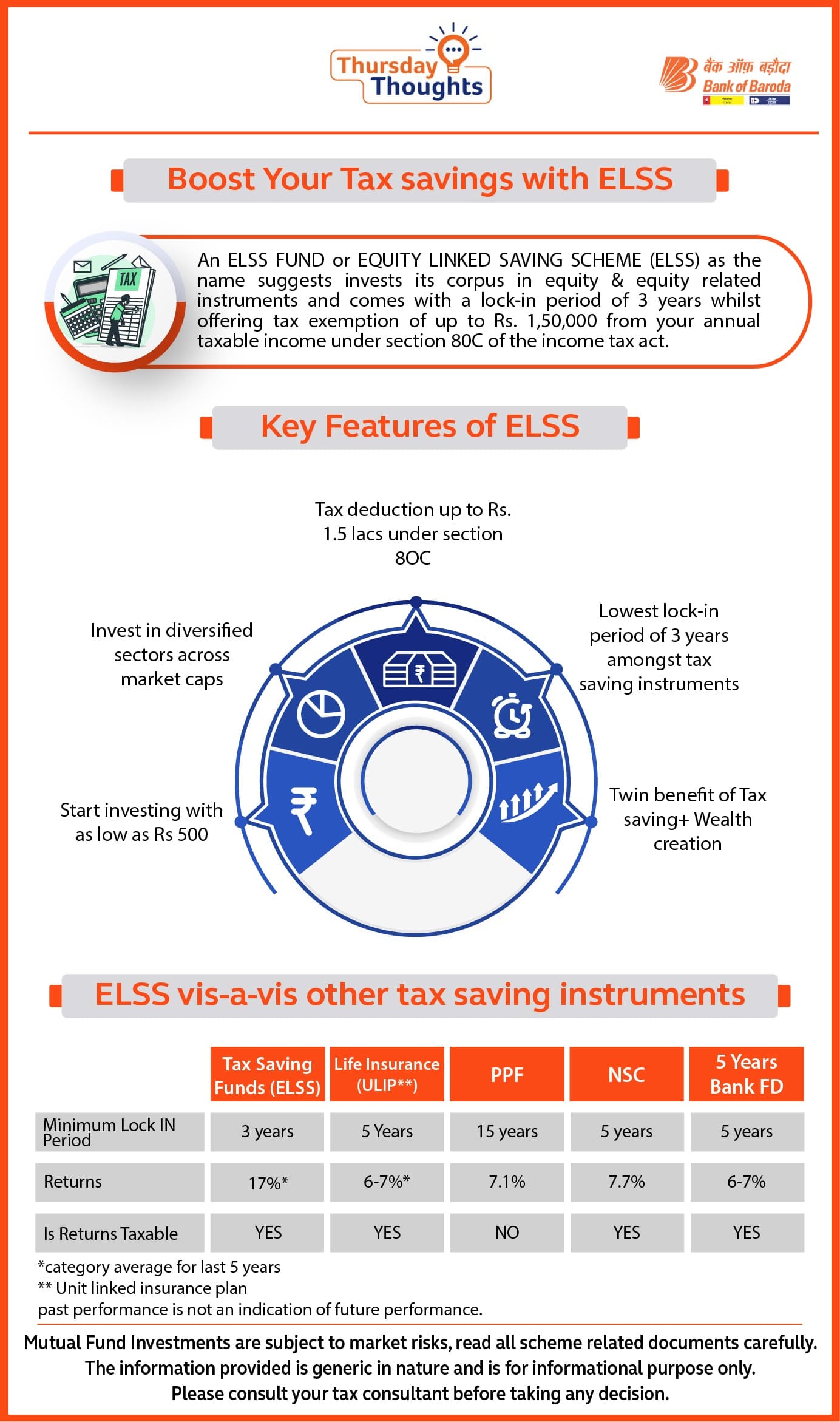

Boost Your Tax savings with ELSS

An ELSS FUND or EQUITY LINKED SAVING SCHEME (ELSS) as the name suggests invests its corpus in equity & equity related instruments and comes with a lock-in period of 3 years whilst offering tax exemption of up to Rs. 1,50,000 from your annual taxable income under section 80C of the income tax act.

Key Features of ELSS

- Tax deduction up to Rs. 1.5 lacs under section 80C

- Lowest lock-in period of 3 years amongst tax saving instruments

- Twin benefit of Tax saving+ Wealth creation

- Invest in diversified sectors across market caps

- Start investing with as low as Rs 500

ELSS vis-a-vis other tax saving instruments

| Tax Saving Funds (ELSS) | Life Insurance (ULIP**) | PPF | NSC | 5 Years Bank FD | |

|---|---|---|---|---|---|

| Minimum Lock IN Period | 3 years | 5 years | 15 years | 5 years | 5 years |

| Returns | 17%* | 6~7%* | 7.1% | 7.7% | 6~7% |

| Is Returns Taxable | YES | YES | NO | YES | YES |

**Unit linked insurance plan

past performance is not an indication of future performance.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. The information provided is generic in nature and is for informational purpose only. Please consult your financial advisor before taking any decision.

Popular Infographics

Related Infographics

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.

Leave a Comment

Thanks for submitting your details.