All about Mutual Fund Returns

02 Nov 2023

All about Mutual Fund Returns

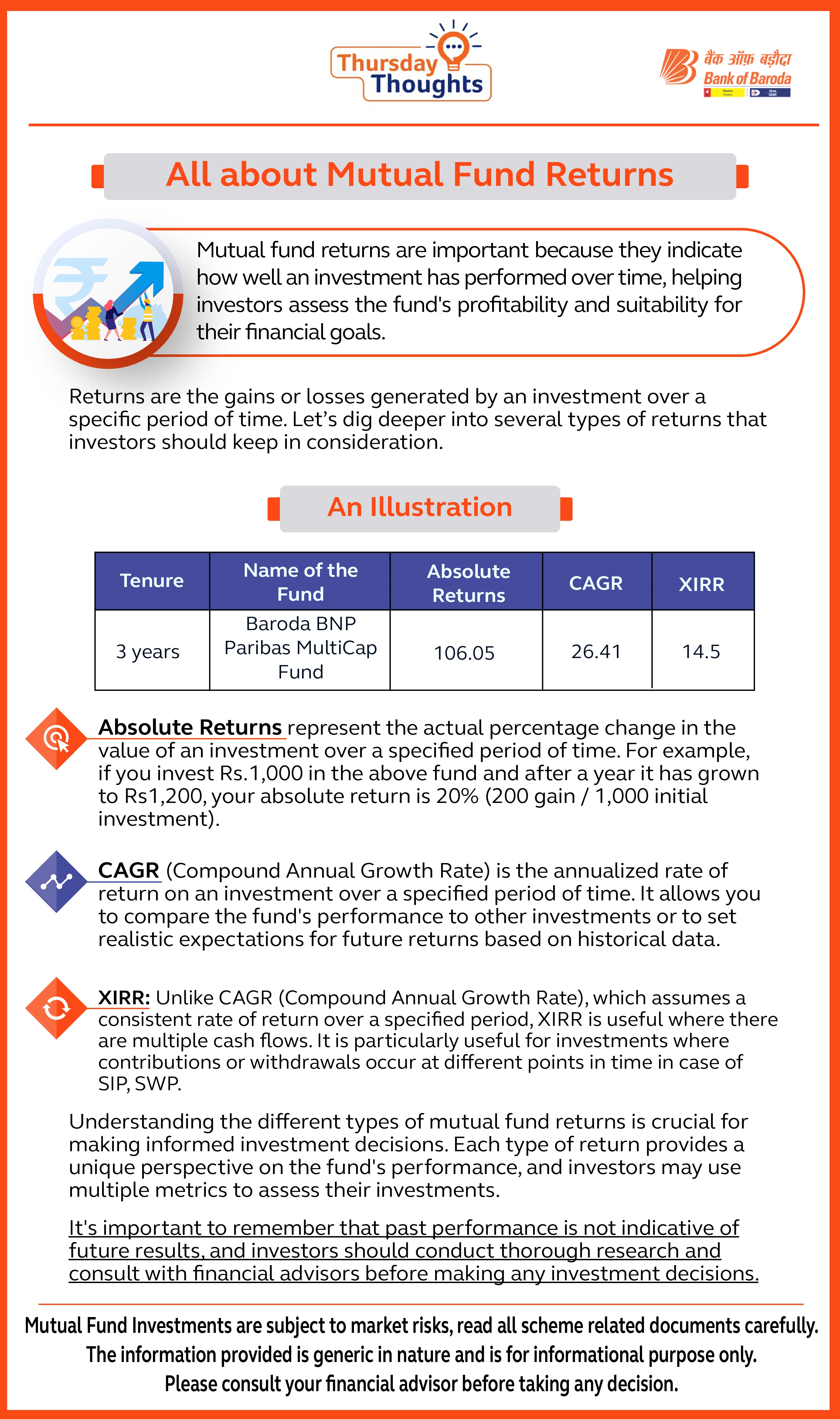

Mutual fund returns are important because they indicate how well an investment has performed over time, helping investors assess the fund's profitability and suitability for their financial goals.

Returns are the gains or losses generated by an investment over a specific period of time. In the context of mutual funds, let’s dig deeper into several types of returns that investors should keep in consideration.

An Illustration

| Tenure | Name of the Fund | Absolute Returns | CAGR | XIRR |

|---|---|---|---|---|

| 3 years | Baroda BNP Paribas MultiCap Fund | 106.05 | 26.41 | 14.5 |

Absolute returns

Absolute returns represent the actual percentage change in the value of an investment over a specified period of time. For example, if you invest Rs.1,000 in the above fund and after a year it has grown to Rs1,200, your absolute return is 20% (200 gain / 1,000 initial investment).

CAGR

CAGR (Compound Annual Growth Rate) is the annualized rate of return on an investment over a specified period of time. It allows you to compare the fund's performance to other investments or to set realistic expectations for future returns based on historical data.

XIRR

XIRR- Unlike CAGR (Compound Annual Growth Rate), which assumes a consistent rate of return over a specified period, XIRR is useful where there are multiple cash flows. It is particularly useful for investments where contributions or withdrawals occur at different points in time in case of SIP, SWP.

Understanding the different types of mutual fund returns is crucial for making informed investment decisions. Each type of return provides a unique perspective on the fund's performance, and investors may use multiple metrics to assess their investments.

It's important to remember that past performance is not indicative of future results, and investors should conduct thorough research and consult with financial advisors before making any investment decisions.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. The information provided is generic in nature and is for informational purpose only. Please consult your financial advisor before taking any decision.

Popular Infographics

Tag Clouds

Related Infographics

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.

Leave a Comment

Thanks for submitting your details.