Know This Before Buying Gold

25 May 2023

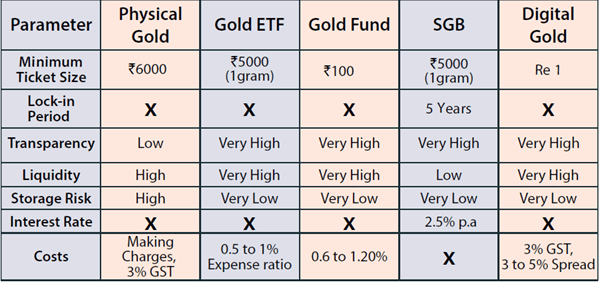

Gold is a popular investment option for the below mentioned reasons

Portfolio diversification:

Gold can be a good way to diversify your investment portfolio. It is a non-correlated asset, which means that its price does not move in the same direction as other assets, such as stocks and bonds. This can help to reduce your overall risk.

Hedge against inflation:

Gold has historically been a good hedge against inflation. When the value of the currency decreases, the value of gold tends to increase. This is because gold is seen as a store of value.

Tangible asset:

Gold is a tangible asset, which means that it can be held in your hand. This can be appealing to some investors who want to have a physical asset that they can see and touch.

Liquidity:

Gold is a liquid asset, which means that it can be easily bought and sold. This makes it a good option for investors who need to access their money quickly.

Low maintenance:

Gold is a low-maintenance asset. It does not require any special care or storage

Popular Infographics

Tag Clouds

Related Infographics

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.