What is the Ideal Long-Term Horizon in Equities?

30 नवम्बर 2023

What is the Ideal Long-Term Horizon in Equities?

Investing in equity funds for the long term can be a strategic approach to wealth building. Historically, equities have shown the potential for higher returns over extended periods. Long-term investment in equity funds allows investors to ride out market volatility, benefit from compounding, and potentially achieve capital appreciation.

Defining Long Term

The below criteria can be used to define a period as long term:

• A time frame where investments avoid losses.

• It has high probabilitty to generate double digit returns.

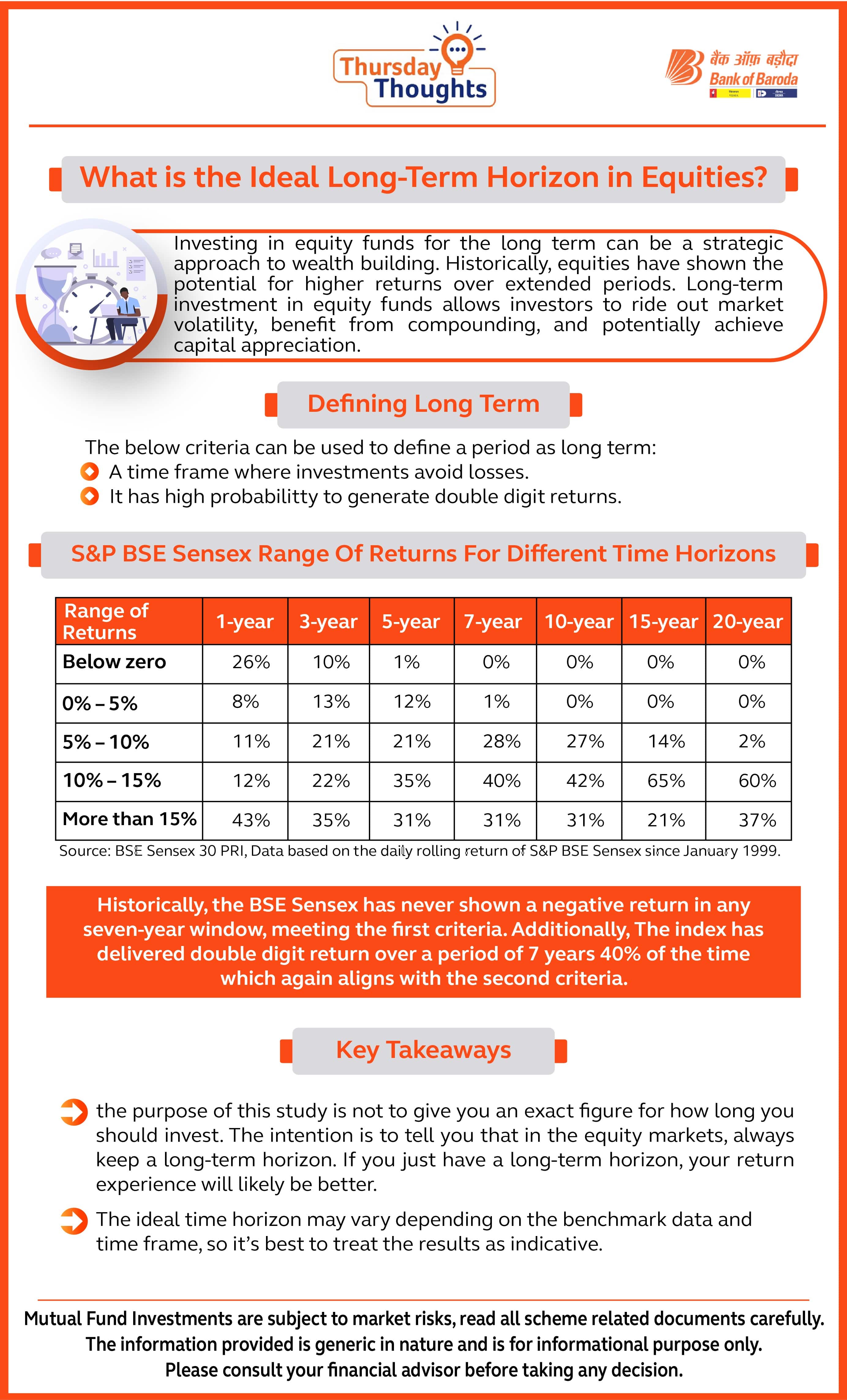

S&P BSE Sensex Range Of Returns For Different Time Horizons

| Range of Returns | 1-year | 3-year | 5-year | 7-year | 10-year | 15-year | 20-year |

|---|---|---|---|---|---|---|---|

| Below zero | 26% | 10% | 1% | 0% | 0% | 0% | 0% |

| 0%-5% | 8% | 13% | 12% | 1% | 0% | 0% | 0% |

| 5%-10% | 11% | 21% | 21% | 28% | 27% | 14% | 2% |

| 10%-15% | 12% | 22% | 35% | 40% | 42% | 65% | 60% |

| More than 15% | 43% | 35% | 31% | 31% | 31% | 21% | 37% |

Source: BSE Sensex 30 PRI, Data based on the daily rolling return of S&P BSE Sensex since January 1999

Historically, the BSE Sensex has never shown a negative return in any seven-year window, meeting the first criteria. Additionally, The index has delivered double digit return over a period of 7 years 40% of the time which again aligns with the second criteria.

Key Takeaways

1. the purpose of this study is not to give you an exact figure for how long you should invest. The intention is to tell you that in the equity markets, always keep a long-term horizon. If you just have a long-term horizon, your return experience will likely be better.

2. The ideal time horizon may vary depending on the benchmark data and time frame, so it’s best to treat the results as indicative.

Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. The information provided is generic in nature and is for informational purpose only. Please consult your financial advisor before taking any decision.

Popular Infographics

Tag Clouds

Related Infographics

Nomination in Financial Planning: Ensure Seamless Asset Transfer with Expert Nomination Strategies

Public Provident Fund (PPF): A Secure Tax-Saving Investment for Long-Term Growth

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.

Leave a Comment

Thanks for submitting your details.