Tackling market volatility

02 जून 2022

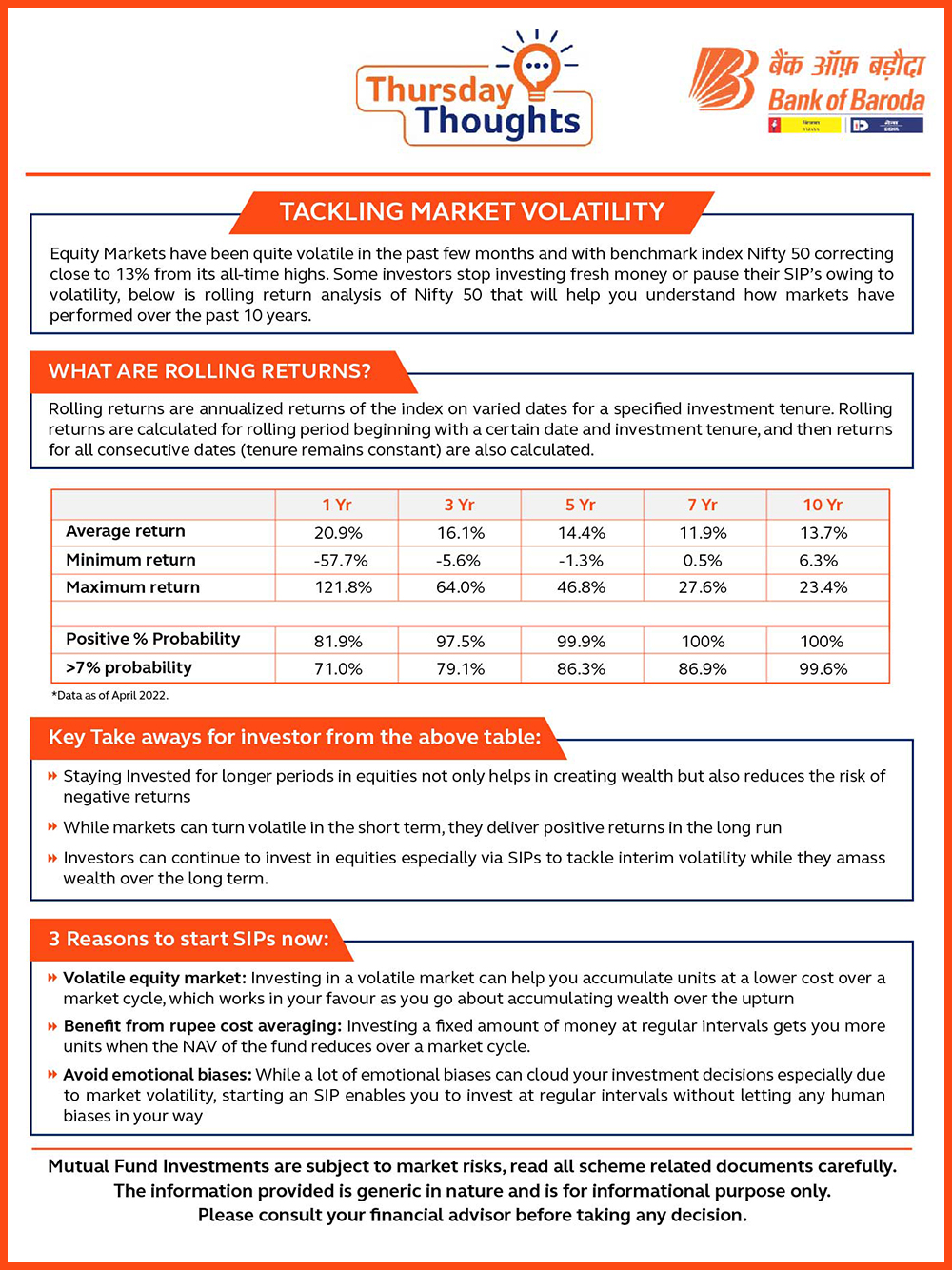

Equity Markets have been quite volatile in the past few months and with benchmark index Nifty 50 correcting close to 13% from its all-time highs. Some investors stop investing fresh money or pause their SIP’s owing to volatility, below is rolling return analysis of Nifty 50 that will help you understand how markets have performed over the past 10 years.

What are rolling returns?

Rolling returns are annualized returns of the index on varied dates for a specified investment tenure. Rolling returns are calculated for rolling period beginning with a certain date and investment tenure, and then returns for all consecutive dates (tenure remains constant) are also calculated.

| 1 Yr | 3yr | 5yr | 7yr | 10 yr | |

|---|---|---|---|---|---|

| Average return | 20.9% | 16.1% | 14.4% | 11.9% | 13.7% |

| Minimum return | -57.7% | -5.6% | -1.3% | 0.5% | 6.3% |

| Maximum return | 121.8% | 64.0% | 46.8% | 27.6% | 23.4% |

| Positive % Probability | 81.9% | 97.5% | 99.9% | 100% | 100% |

| >7% probability | 71.0% | 79.1% | 86.3% | 86.9% | 99.6% |

*Data as of April 2022.

Key Take aways for investor from the above table:

- Staying Invested for longer periods in equities not only helps in creating wealth but also reduces the risk of negative returns

- While markets can turn volatile in the short term, they deliver positive returns in the long run

- Investors can continue to invest in equities especially via SIPs to tackle interim volatility while they amass wealth over the long term.

3 Reasons to start SIPs now:

• Volatile equity market

Investing in a volatile market can help you accumulate units at a lower cost over a market cycle, which works in your favour as you go about accumulating wealth over the upturn

• Benefit from rupee cost averaging:

Investing a fixed amount of money at regular intervals gets you more units when the NAV of the fund reduces over a market cycle.

• Avoid emotional biases:

While a lot of emotional biases can cloud your investment decisions especially due to market volatility, starting an SIP enables you to invest at regular intervals without letting any human biases in your way

Popular Infographics

Tag Clouds

Related Infographics

-

Disclaimer

The contents of this article/infographic/picture/video are meant solely for information purposes and do not necessarily reflect the views of Bank of Baroda. The contents are generic in nature and for informational purposes only. It is not a substitute for specific advice in your own circumstances. Bank of Baroda and/ or its Affiliates and its subsidiaries make no representation as to the accuracy; completeness or reliability of any information contained herein or otherwise provided and hereby disclaim any liability with regard to the same. The information is subject to updation, completion, revision, verification and amendment and the same may change materially. The information is not intended for distribution or use by any person in any jurisdiction where such distribution or use would be contrary to law or regulation or would subject Bank of Baroda or its affiliates to any licensing or registration requirements. Bank of Baroda shall not be responsible for any direct/indirect loss or liability incurred by the reader for taking any financial decisions based on the contents and information mentioned. Please consult your financial advisor before making any financial decision.

Leave a Comment

Thanks for submitting your details.